Episode 104: 1st Quarter 2023 Investment Review & Economic Update (podcast)

Podcast: Play in new window | Download

The US has been down here before and we let it get worse than this to the point where our debt actually got downgraded and nobody really

seemed to care. Nobody was selling their treasuries or not buying treasuries because it was downgraded.

Check out the Diversification Matters chart we reference in this episode.

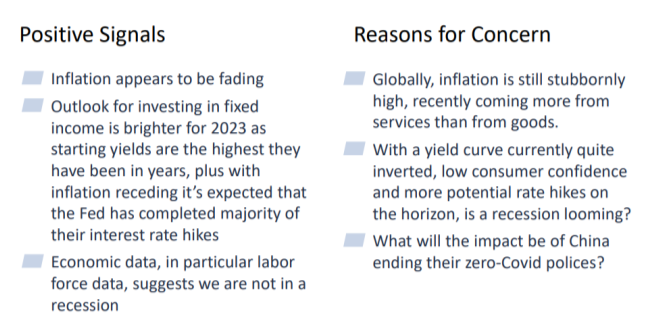

We usually talk about surprises in terms of being bad for the market, but the flip side of that is the surprise is a good thing and there is a scenario out there where the fed gets it right.

So there’s just no telling where we’re at and what’s going to happen. It’s a matter of being a long-term investor and not worrying about what’s going to happen six months from now.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.