The Power of Investing During Down Markets (podcast)

Podcast: Play in new window | Download

It’s an often–repeated cliché about the markets: Stocks are the only thing Americans do not like to buy on sale. When the markets fall, people cut back on contributions to retirement accounts and repeatedly miss out on a golden opportunity to buy shares at low prices.

The concept is simple: If you are buying a fixed dollar amount of an investment every month, purchasing on down months means buying more shares, which in turn means a better return when the market rebounds. The problem is that doing so requires faith that the markets will rebound, and the best opportunities to buy come exactly when doing so feels the worst.

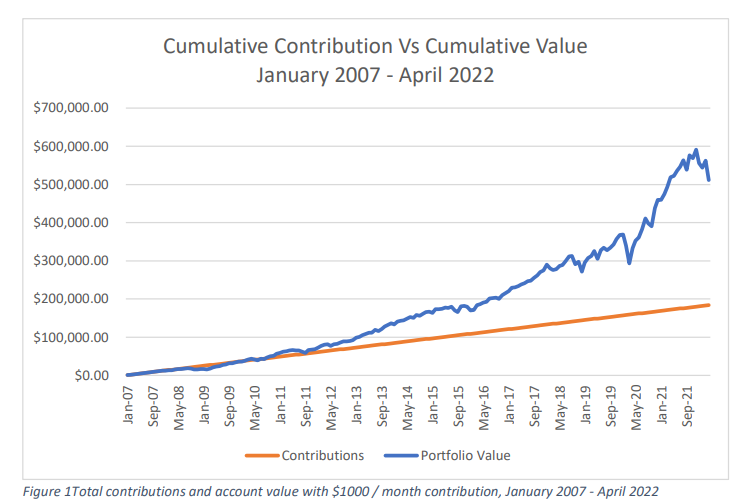

To illustrate this idea, we ran an experiment: We built a spreadsheet showing what would happen if someone purchased $1,000 of the Vanguard Total Market Fund (a broad-based stock portfolio covering the entire domestic market) every month from the beginning of 2007 through the end of April 2022.

We chose the timeframe to capture the market before and during the financial crisis, along with the recovery, so we could compare individual $1,000 deposits and their return over time.

The experiment quite clearly illustrates the power of investing in down markets and continuing to invest despite the doom and gloom we were all feeling at the time.

Here are a few of our observations:

• Looking at the annualized return of each $1,000 deposit, the contribution with the highest return were those made at the bottom of the market in February and March of 2009. The Cumulative Contribution Vs Cumulative Value Contributions Portfolio Value $1,000 contributions would have grown to $6,666.48 by April 2022, for an average annualized return of 15.01%, while the average return of the entire fund was only 10.93%. The best-annualized return was for the shares purchased at the market’s bottom.

• The worst of the financial crisis, from the fall of 2007 through the spring of 2009, would have been quite discouraging: By March 2009, you would have spent $27,000, but your portfolio value would have only been $17,979.99, a loss of 33.41% over that period. However, the

number of shares was rising by a higher number as every monthly $1,000 investment was able to purchase more shares at lower prices. By March 2009, the share total was 304.23 shares. For comparison’s sake, if the market had stayed flat through this period, you would only have

265.07 shares. While that might have FELT better than seeing negative returns, by consistently buying more shares as the market dropped, your portfolio was well–positioned to outpace the market during the rebound.

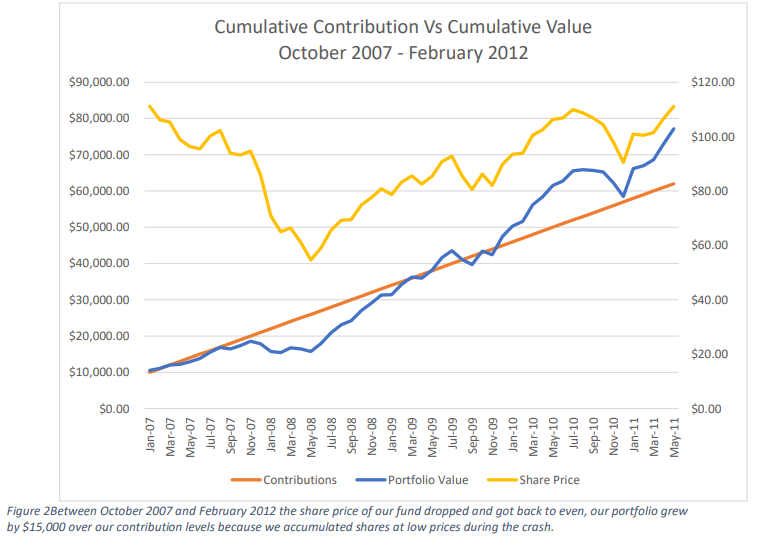

• The market turned around abruptly in March of 2009, and the Vanguard Total Market Fund we used in this project started to rise with it. It took the fund until February of 2012 to get back to its pre-crash level. While the fund only broke even over that time, if you had continued to invest as the market fell your portfolio would have grown by $15,180 over that time frame, for a cumulative return of 24.48%

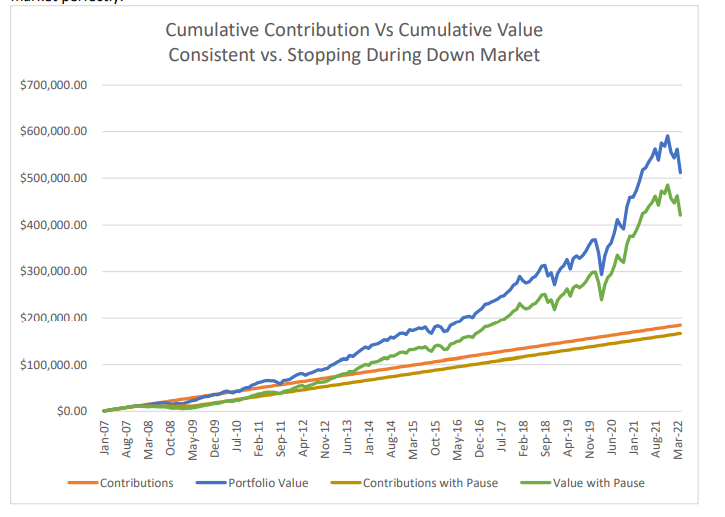

To really drive home the value of investing during a falling market, let’s say you wanted to stop contributing when the market is falling, and you were able to time it perfectly, pausing your contributions in November of 2007 and not resuming them until the market had bottomed out in March of 2009. While you may have felt that you were protecting yourself, that pause would have cost you immensely. Sitting out the crash would have meant $18,000 less in contributions, but the difference in portfolio value by 2022 would have been $90,625! You would have missed out on $72,625 in compounded growth on that $18,000. And that is only if you timed the market perfectly.

Investing always feels better when the market is posting positive returns and prospects look good, but as this real example from the Financial Crisis illustrates, sticking with a consistent plan, particularly when the market feels horrible, can lead to a very powerful outcome. The shares you buy with your contributions in down markets become the most valuable shares you own for funding your long-term goals.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: