Top 5 Investor Concerns for the Second Half of 2021

2021 has been a historic year for the economy and stock market.

Economic activity is recovering at a once-in-a-lifetime pace as businesses expand and consumers spend. While the recession and recovery have been unusual by historical standards, there are reasons to believe that diversified portfolios can do well, even with the uncertainty of inflation and rising interest rates.

While the comparison to pre-pandemic levels is natural, the market is already looking further down the road. Consensus expectations are that the economy will hit a new gear as the cycle continues. The pent-up demand in spending on both goods and services could be met by a further ramp-up in new hiring activity by businesses large and small. Today, there are as many job openings in the U.S. as there are unemployed individuals.

What can long-term investors learn from the past several months as they prepare for the second half of the year?

Top 5 Investor Concerns for the Second Half of 2021

#1 Has the economy fully recovered?

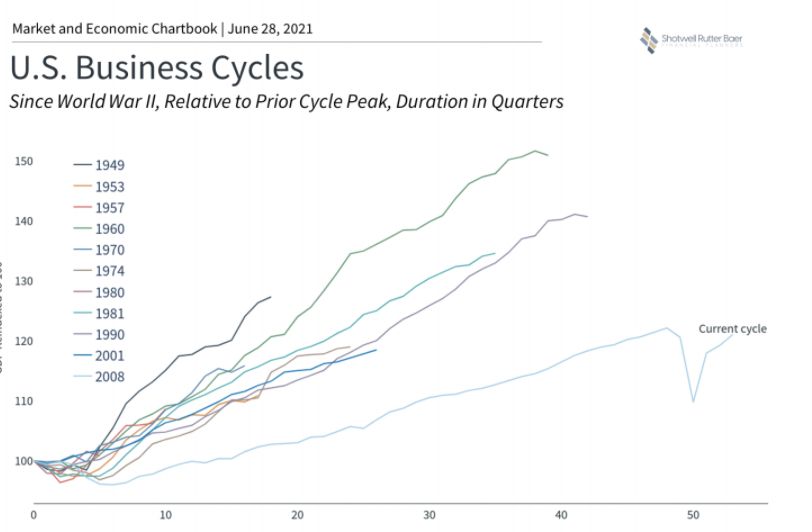

The U.S. economy, measured by GDP, had already recovered to within 1% of its pre-pandemic peak at the end of the first quarter. All signs point to an economy that achieved new highs in the second quarter. From industrial production to retail sales, nearly all gauges of economic activity show signs of strong growth. Of course, this is expected during the early stages of recovery and reasonable investors should expect the pace to slow somewhat.

#2 Are stocks still attractive?

The economic recovery has directly translated into a recovery in corporate profits. S&P 500 earnings-per-share are also back to pre-pandemic levels which help to make valuations levels more attractive. Like GDP, consensus estimates are for earnings to grow at a healthy pace over the next 12-24 months.

#3 Will inflation overheat?

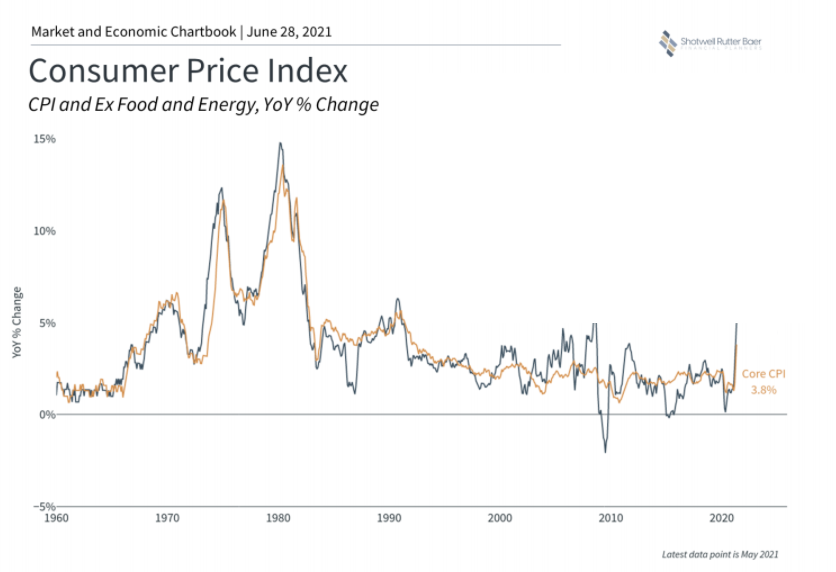

One red flag has been rising inflation which is often a sign of an overheating economy. The fact that price pressures have generally been subdued since the early 1980s has made it more important for investors to understand the risks to their portfolios.

However, it’s also important to understand what is driving inflation today. First, the recovery is naturally pushing prices higher compared to mid-2020. Second, supply and demand disruptions have occurred across industries but should eventually clear. Third, the Fed continues to keep monetary policy loose and the government is stimulating the economy. While the first two factors could resolve themselves over time, the last one is still a significant uncertainty.

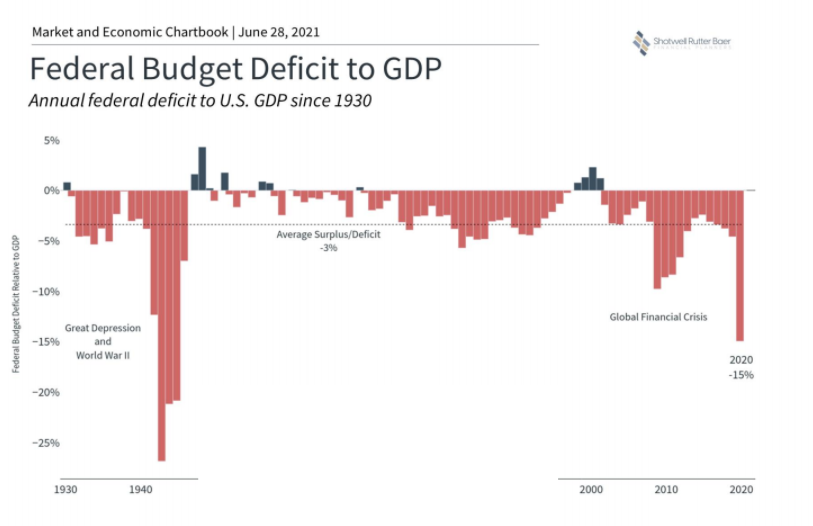

#4 How big is the government deficit?

Government emergency spending over the past 18 months pushed the federal deficit to levels not seen since the Great Depression. However, this is typically what happens during economic crises and times of war. As the economy recovers and emergency stimulus is no longer needed, the deficit should improve as a percentage of GDP.

While many investors would prefer that the government-run balanced budgets or generate surpluses for a rainy day, this seems unlikely. Instead, it’s important for investors to not overreact in their portfolios to short-term government spending.

#5 Will the Fed end the party?

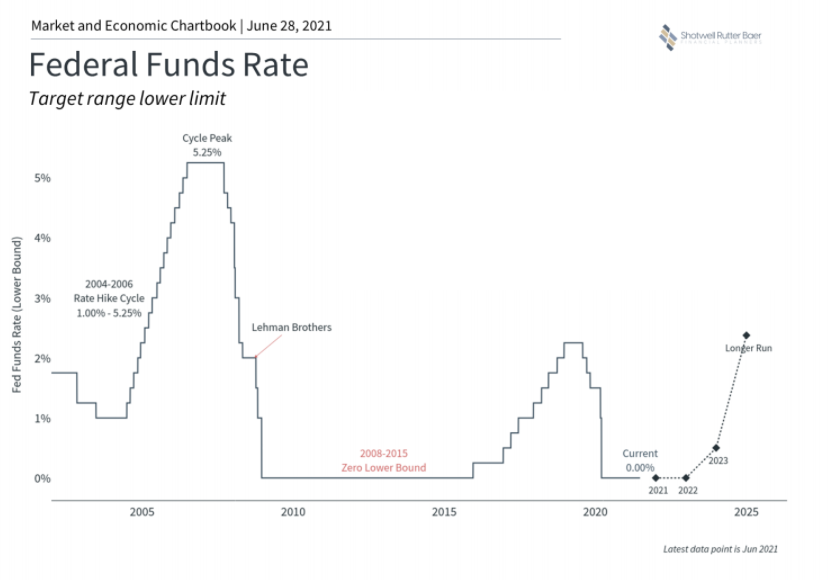

With the economy fully recovered and inflation rising, many are expecting the Fed to begin “tapering” its balance sheet expansion and then raise rates. The Fed’s latest projections show that they expect rates to begin rising in 2023 – at least a year and a half away.

Of course, this could begin sooner if the data heat up more. Even when the Fed does begin to slow its bond purchases, it will likely do so gradually. All told, the Fed will probably be cautious and keep monetary policy loose for quite some time.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Charts courtesy of Clearnomics. For a full explanation of the various indices and methodologies used, please contact us at info@srbadvisors.com

Share post: