2025 Market Outlook: 5 Insights to Achieve Portfolio Balance

The following piece is brought to you by our friends at Clearnomics

Check out our Kitchen Table Finance Podcast where Dave and Nick discuss this in detail. Listen HERE

The 19th-century author Balzac wrote that “our worst misfortunes never happen, and most miseries lie in anticipation.” This quote perfectly captures 2024, a year of major market, economic, and political concerns for many investors. Worries over a “hard landing” recession, market pullbacks, election turmoil, and more drove market sentiment to extremes.

Yet, as we approach the end of the year, many of the miseries that investors feared did not take place. Instead, the S&P 500 is near record levels, inflation is subsiding, the economy is growing steadily, and the Fed has begun to cut interest rates. This is a reminder that excessive worry can lead investors to make decisions that may not serve their long-term interests.

If the past few years have been about extremes – the bear markets of 2020 and 2022, compared to the sharp rebounds in 2021, 2023, and 2024 – then 2025 should be about regaining balance. This is as much about investor emotion as it is about economic data.

History shows that those who can maintain a disciplined, long-term approach are better positioned to achieve financial success. This will only grow in importance in the coming year. Stock market valuations are well above average, the path of interest rates is uncertain, doubts about artificial intelligence are emerging, and geopolitical risks are escalating. There will likely be many more unforeseen events that will heighten investor concerns.

Fortunately, the lessons of the past year can guide financial decisions in 2025 and beyond. Below, we present five important insights that can provide investors with perspective even when the world seems uncertain and other investors fear the worst.

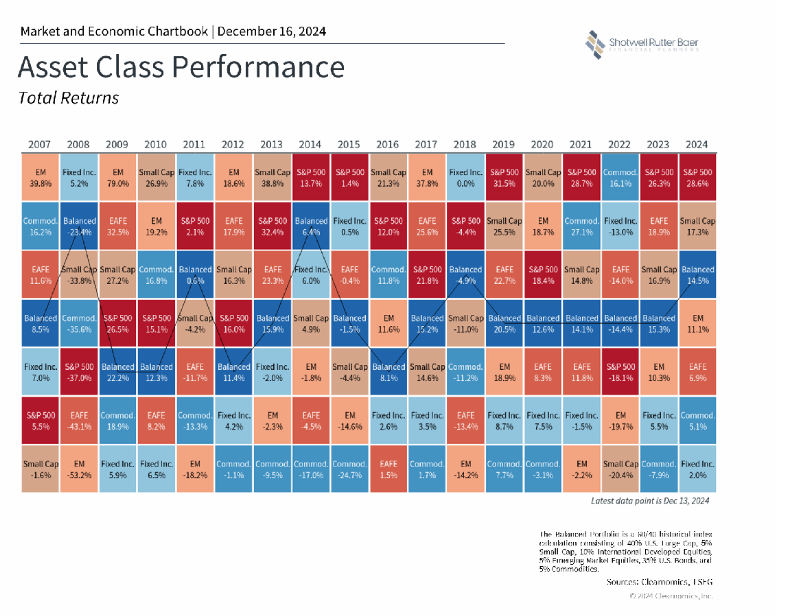

A stronger-than-expected economy has supported all asset classes

A year ago, investors spent much of their time worrying about a “hard landing” as the Fed kept rates high to fight inflation. Fortunately, this never materialized. Instead, inflation is returning to pre-pandemic levels, the job market is healthy, and economic growth is steady. Few investors expected such a positive scenario twelve months ago.

The Consumer Price Index, a measure of inflation, has slowed to only 2.6% year-over-year. Unemployment remains low at only 4.2%, and 2.3 million new jobs have been created over the past twelve months. GDP growth, at 2.8% in the third quarter, has been stronger than many economists anticipated.

This economic expansion has helped to propel many asset classes. U.S. stock market indices are near all-time highs, international stocks have continued to rise, and bonds have performed better in recent weeks with interest rates moderating. Gold is near record levels due to demand from investors and central banks. Bitcoin has also risen to historic highs following the presidential election.

This does not mean there are no challenges ahead. Consumer spending could slow as excess savings are spent, and debt levels are high for both households and businesses. Assets that have risen sharply could experience greater volatility as well. In times like these, focusing on fundamentals such as earnings and valuations will be important.

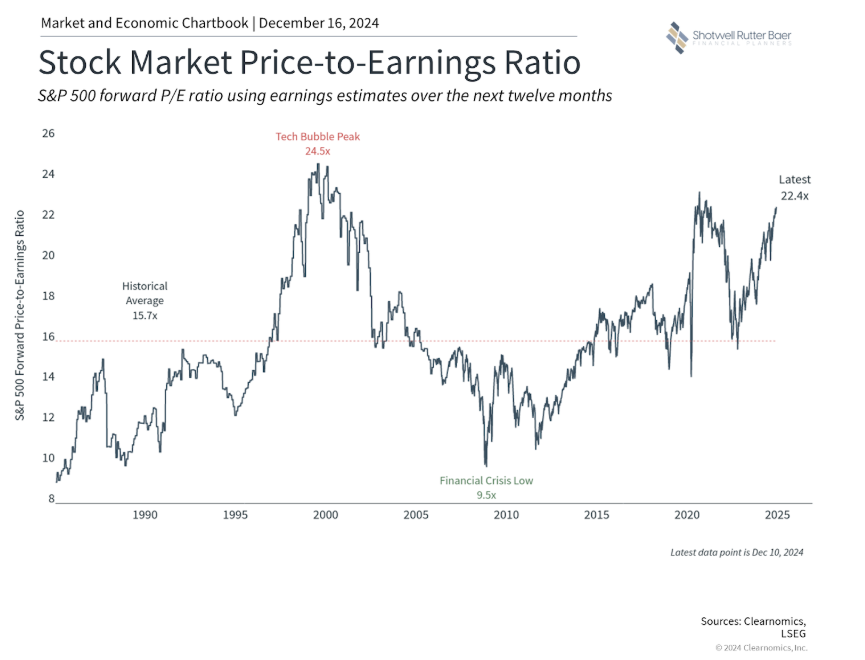

Expensive stock market valuations underscore the need for portfolio management

One reason for higher stock prices is the strength of corporate America. Corporate earnings have grown 8.6% over the past twelve months, rising to $236 per share for the S&P 500.

However, the fact that the stock market has risen far more than earnings means that valuations have increased. The price-to-earnings ratio is 22.3, meaning that investors are paying $22.30 today for every dollar of future earnings. This is well above the historical average of 15.7, and is nearing the historic peak of 24.5 during the dot-com bubble.

Valuations matter because paying a higher price today means, all else equal, a lower return in the future. For investors, this has two implications. First, it’s important to construct portfolios by balancing stocks with other asset classes such as bonds and international investments. Second, with stock market indices at historically expensive levels, it’s critical to focus on more attractive parts of the markets.

For example, while artificial intelligence stocks have driven market returns over the past two years, many other parts of the market have performed well recently. Year to date, all eleven sectors have generated positive gains. Given that it is difficult to predict which sectors may outperform each year, having an appropriate allocation to many parts of the market can help to stabilize portfolios.

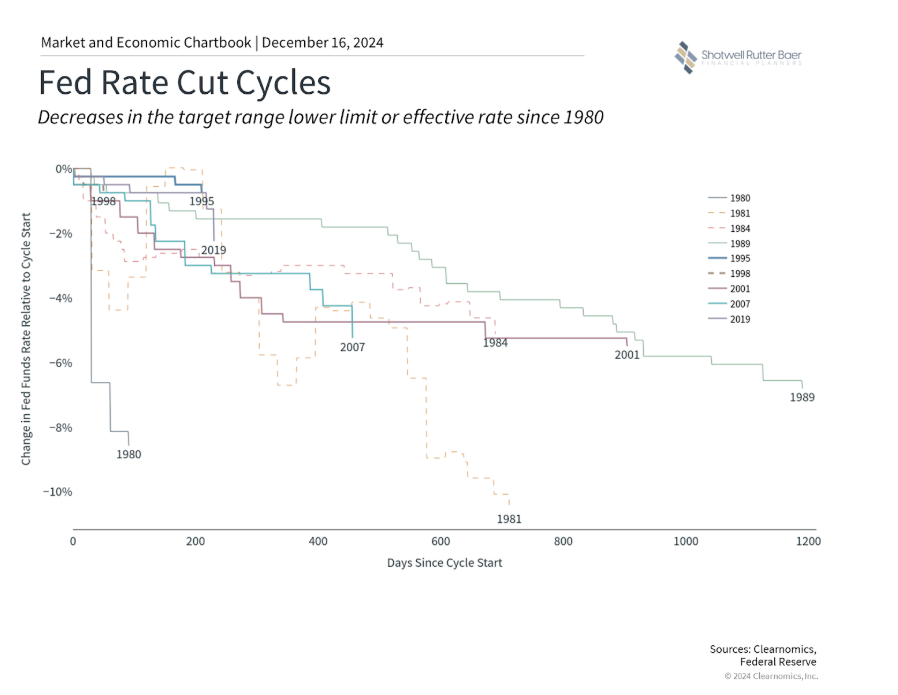

The Fed is expected to cut rates further

The Fed began to cut policy rates in September after months of investor speculation. So far, the Fed has lowered rates by three-quarters of one percent, with markets expecting three or four more additional cuts by the end of 2025.

The timing and magnitude of these rate cuts remain uncertain and will depend on the economic data. Regardless, the monetary policy headwinds that began in 2022 are now turning into tailwinds. Just as higher rates slowed economic growth and led to investor concerns, lower rates can help to stimulate the economy, supporting both corporate earnings and possibly stock market returns in the

long run.

After a few challenging years, the easing of monetary policy may also be positive for bonds as inflation and economic growth potentially enter a more stable period. If short-term rates trend lower and longer-term rates remain steady, the prices of many bonds could benefit while still offering attractive yields. This environment may present opportunities for diversified investors to generate both income and growth.

For investors, what matters is not trying to guess each move by the Fed, but the overall path of rates. With greater clarity and guidance around Fed policy, the market’s attention may shift back to specific policies by the incoming Trump administration.

The political focus will shift from the election to policy

Presidential politics also clouded markets leading up to election day in November. Since then, the stock market has rallied due to the lifting of policy uncertainty, and the hopes that the incoming administration will create a pro-growth environment. Of course, just under half of the country does not agree with the new administration’s policies. National politics have only grown more divisive in recent years, and it is often difficult to separate personal views from investment decisions.

While politics are important in our personal lives, the reality is that the economy and stock market have performed well across both Democratic and Republican presidencies over the past century. When it comes to investing, business cycles matter more than who occupies the White House, and they are driven by many factors beyond politics.

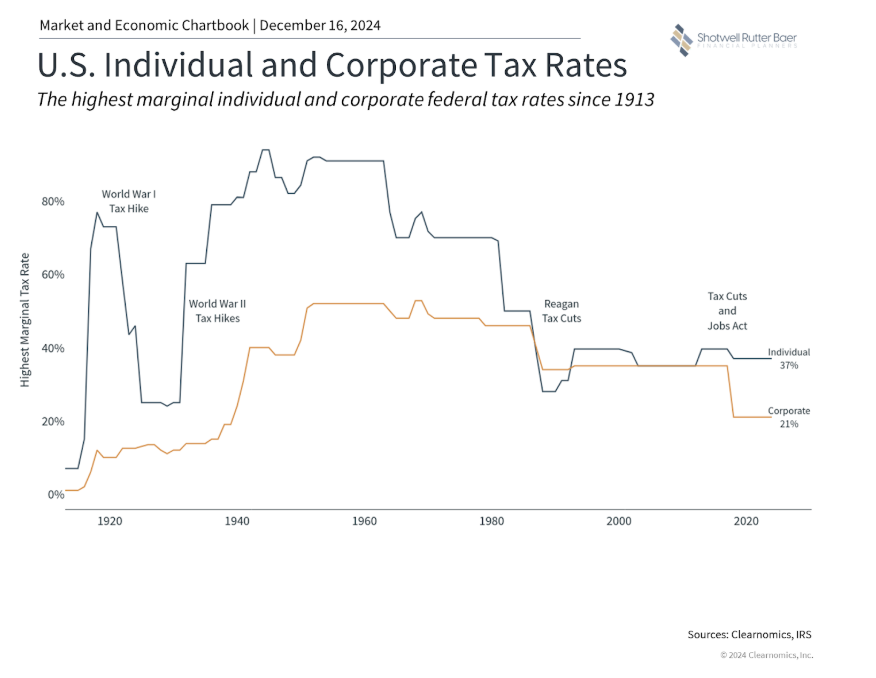

In 2025, investors should put politics aside as they construct their portfolios and financial plans. Taxes, for instance, are clearer after the election since it is likely that most provisions of the Tax Cuts and Jobs Act will be extended. This affects individual income tax rates, corporate tax rates, estate taxes, and much more. As is always the case, working with a trusted advisor is the best way to ensure that your financial strategy considers tax implications and changing market conditions.

This does not mean that politics will be out of the spotlight in the coming months. Issues such as trade wars and the budget deficit will continue to worry investors. On trade, the new administration is expected to raise tariffs across many trading partners, especially China. However, it’s important to remember that the worst-case predictions during the first Trump administration never materialized, and many tariffs were continued during the Biden administration.

When it comes to debt ceilings and the growing federal deficit, there are no simple solutions. The national debt has grown to $36 trillion with no signs of slowing. Without a sustainable path, interest payments on the federal debt will continue to rise, credit rating agencies may continue to question

the quality of U.S. debt, and the role of the U.S. dollar as the world’s reserve currency could become uncertain. Without minimizing the severity of this topic, it’s important to recognize that we are not at a tipping point just yet, and markets have historically performed well regardless of the level of the deficit and national debt.

Long-term thinking will be key to success in 2025 and beyond

Perhaps the most important lesson of 2024 is that markets can perform well in spite of investors’ worst fears. For example, market pullbacks in April and August this year may have led some investors astray, despite positive gains throughout the year. Markets have shown remarkable resilience over the past twelve months, supported by economic growth, innovation, and positive trends across many asset classes. It’s important to celebrate these positive outcomes, while also remaining vigilant and focused on the long-term.

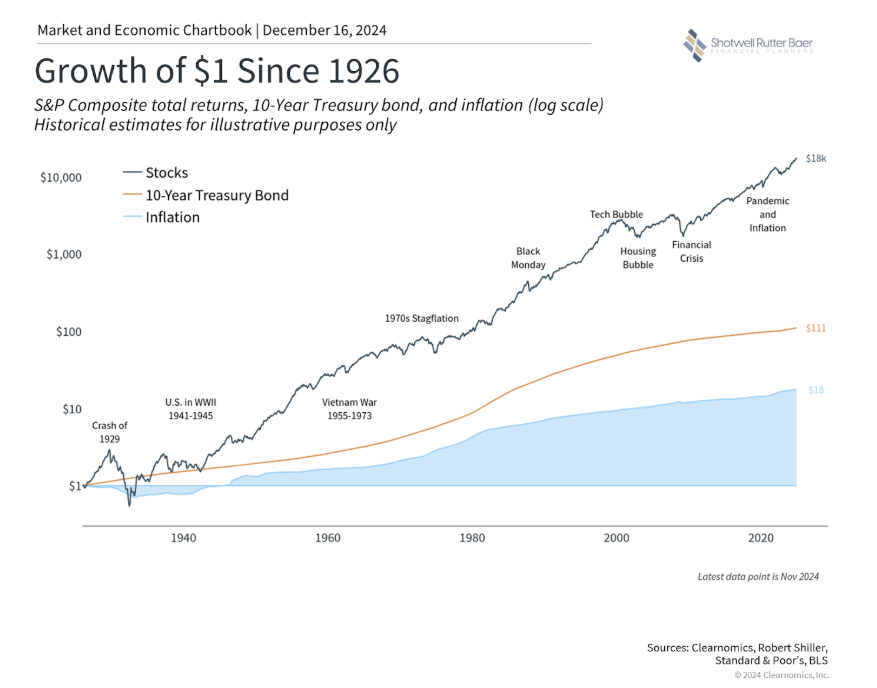

The accompanying chart shows the value of having a long-term perspective. History reveals that true wealth is created not over months, but over years and decades. Even for those already in retirement, having a longer-term perspective allows investors to put short-term events in context and make productive decisions.

The bottom line? As the year comes to a close, we can celebrate a strong year for markets. In 2025, investors should focus on finding balance in their portfolios. History shows that this is the best way to manage unforeseen events while staying on track to achieve long-term financial goals.

We’d love to hear from YOU! Leave a comment or share your thoughts on how you’re preparing for 2025. Looking for financial guidance? Contact us anytime—we’re here to help you make every dollar count.

Call 517-321-4832 or email info@srbadvisors.com

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as

to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites,

applications or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.