5 INVESTMENT INSIGHTS SECOND QUARTER 2022

Markets Have Stabilized

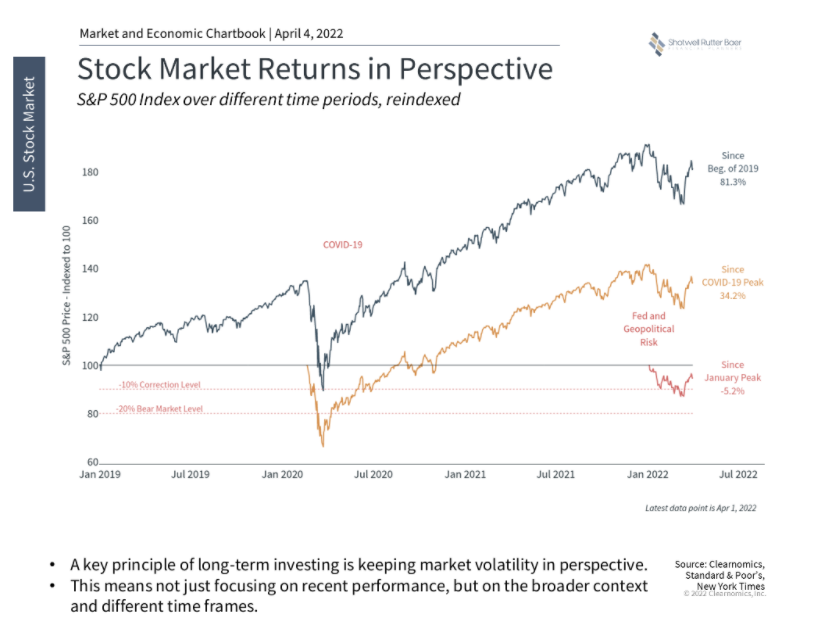

The S&P 500 and other major stock indices have stabilized in recent weeks. Not only was the Fed announcement expected, but oil prices and other factors have calmed as well. Investors should also remember that the market has performed exceptionally well over the past several years, despite the volatility of the first quarter.

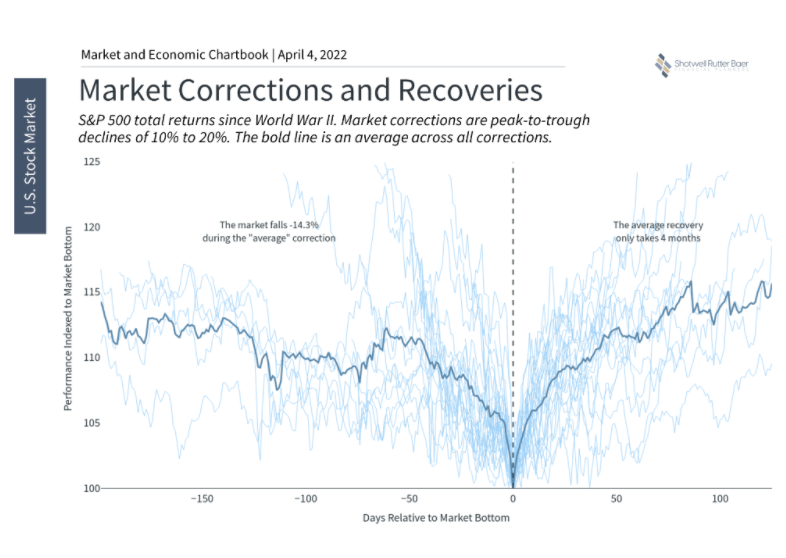

Historically, markets recover from corrections in a matter of months

Corrections are not only normal for the stock market but are unavoidable. For long-term investors, markets can also begin to recover without notice – often when the situation seems the worst. Thus, it’s important to stay invested and not overreact to short-term events.

- This chart shows the two dozen stock market corrections since World War II.

- The average correction sees the market fall -by 14.3% from peak to trough, taking 5 months.

- Recoveries can occur swiftly, taking only 4 months on average. Staying invested helps investors to not miss market rebounds.

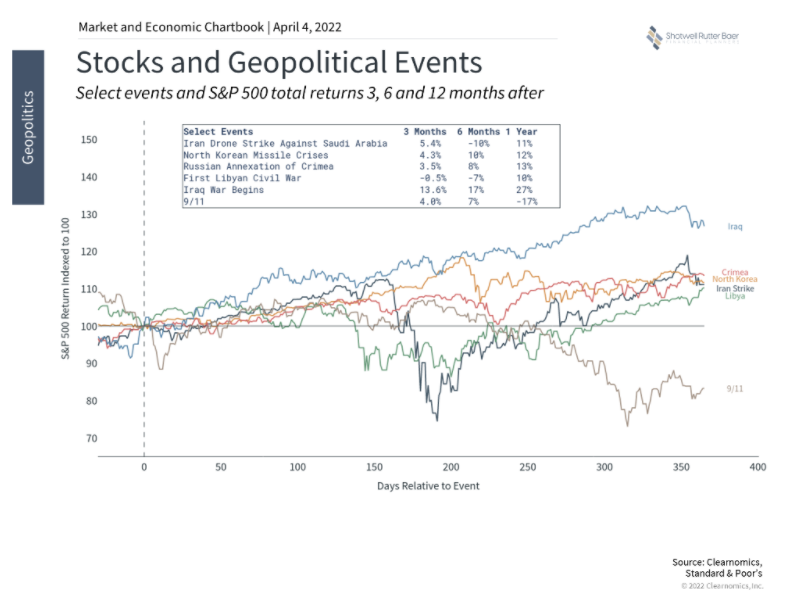

Markets Adjust to Geopolitical Events Quickly

Historically, geopolitical events have had a mixed effect on markets. In some cases, such as Russia’s annexation of Crimea, markets brush these events aside. In other cases, they might make a bad situation worse, such as when 9/11 occurred during the dot-com bear market. However, in all cases, markets tend to adjust quickly.

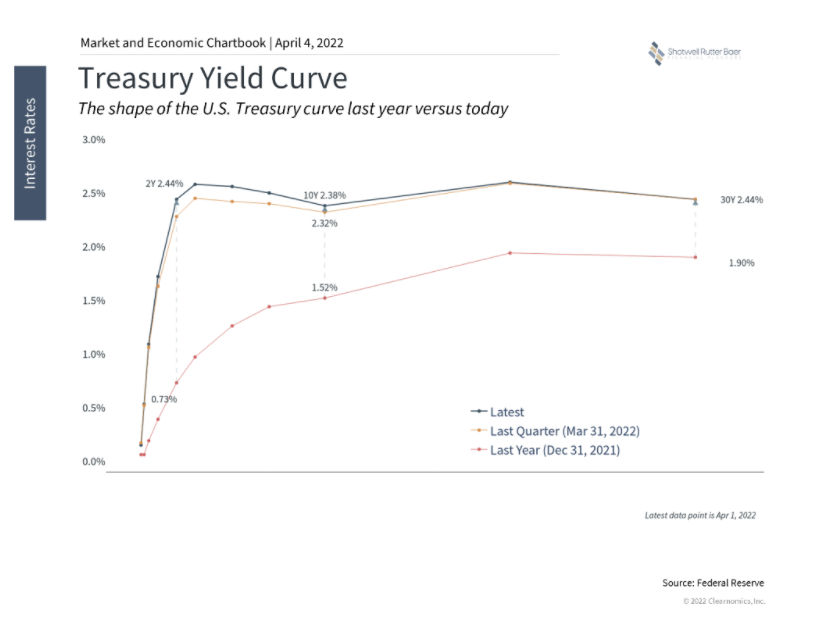

The Yield Curve has Flattened Significantly

The yield curve has flattened with medium and long-term rates jumping in the past several weeks. The short end of the curve, which is heavily influenced by the Fed, should begin to increase as policy rates rise. A flattening curve is normal as the business cycle evolves.

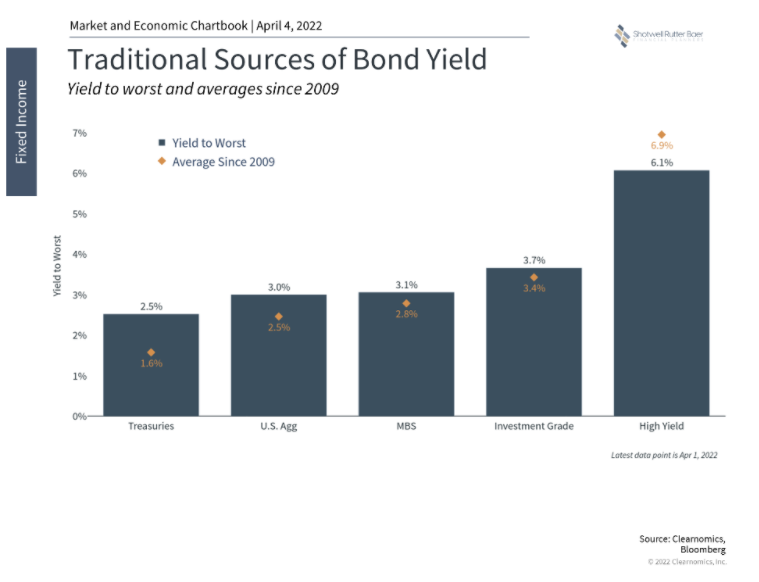

The Silver Lining is it’s Easier to Generate Portfolio Income

Although this has been a challenging year so far for bonds, the silver lining is that yields are higher and, in many cases, above long-run averages. This is an improvement for those investors who rely on portfolio income, especially for those in or near retirement.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: