Blog: How Presidential Elections Affect the Stock Market

From our friends at Clearnomics…

With the presidential election season heating up, there will no doubt be a flurry of daily headlines between now and election day on November 5. A rematch between Joe Biden and Donald Trump seems inevitable with Trump currently leading many presidential polls among registered voters while Biden is raising and spending more campaign funds. Although a lot can happen between now and November, it’s natural for some investors to be concerned about the impact of politics on the stock market and economy. After all, the political climate has never felt more polarized not just due to elections, but also disagreements in Washington around the budget, immigration, foreign policy, and more. How can investors stay balanced during this year’s presidential election?

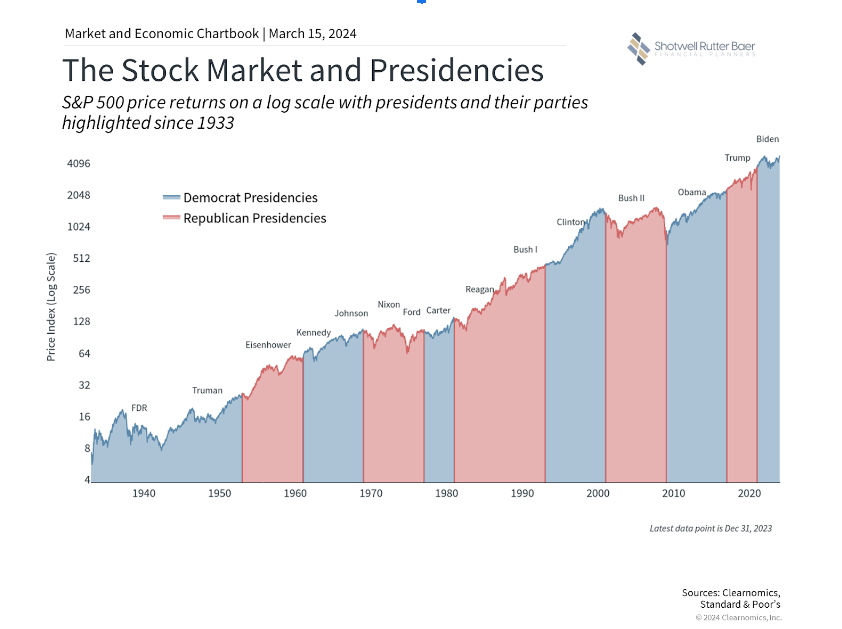

The stock market has performed well under both parties

As citizens, taxpayers, and voters, elections are extremely important regardless of which side of the aisle you’re on and which candidate you support. Your vote helps to determine the principles that will be upheld by the country in the years to come.

However, when it comes to our investments, it’s important to vote at the ballot box and not with our hard-earned savings. When it comes down to it, long-term investors should be wary of claims that one candidate or another will “kill the market” or “ruin the economy.” It’s likely that this has been said about every president in modern times across 15 presidencies since 1933 (7 Republicans and 8 Democrats), and was certainly said about Obama, Trump, and Biden. Thus, it’s important to separate personal and political feelings from financial plans and investments.

The accompanying chart highlights the broad fact that the economy and stock market have performed well across both parties. Focusing too much on who was in the White House would have resulted in poor investment decisions over history, regardless of how strongly one felt. For example, from 2008 through 2020 across the Obama and Trump administrations, the S&P 500 generated a total return of 236%. This occurred despite the vast perceived differences between the parties and the increasing polarization of Washington politics. This also occurred despite many budget battles, fiscal cliffs, debt ceiling crises, U.S. credit rating downgrades, etc., not to mention the global financial crisis, the pandemic, and more.

Of course, this is not to say that good policy doesn’t matter. Policies on taxes, trade, industrial activity, antitrust, and more can have important impacts on specific industries which can then affect the broader economy. However, not only do policy changes tend to be incremental, but also history shows that it is very difficult to predict how any particular policy might affect the economy and markets, despite conventional wisdom about each party. Stock prices account for new policies quickly and companies and industries tend to adjust and adapt.

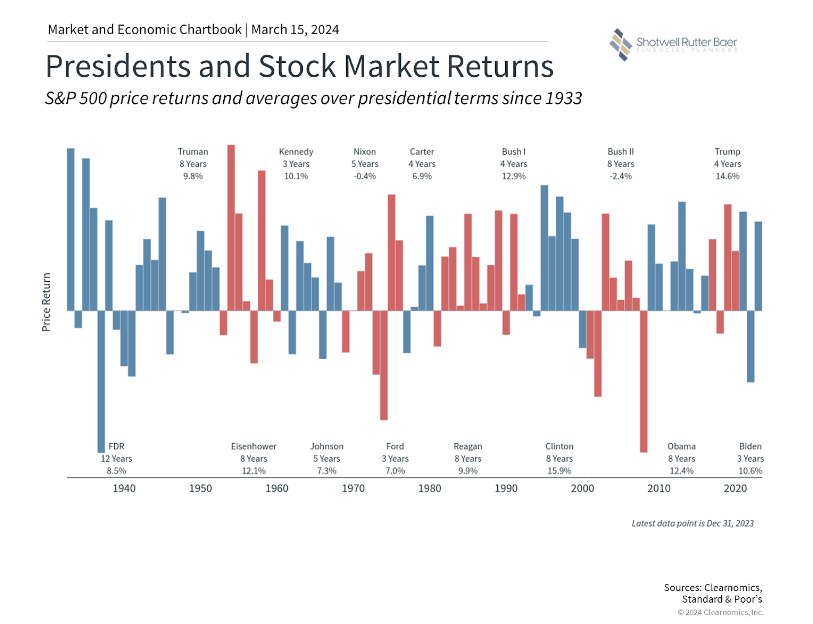

The business cycle matters much more than who is in the White House

This is why for most long-term investors, it makes more sense to focus on fundamentals such as those related to the business cycle, rather than day-to-day election coverage. On a short-term basis, election headlines have the power to move markets and create stock market volatility. However, these moves are eclipsed by the long-term gains created by market and business cycles. These cycles are influenced by many factors, from technological revolutions to globalization, and not just who is sitting in the Oval Office. The reason the returns since 2008 have been historically strong, with the market now back at all-time highs, is less about Obama, Trump, or Biden, than the underlying economic trends.

This is perhaps best illustrated by the 1990s and early 2000s. Bill Clinton’s two terms were perfectly timed with the information technology boom while the ensuing dot-com bust coincided with the start of the George W. Bush presidency. Unfortunately, the 2008 financial crisis also occurred at the tail end of George W. Bush’s second term, resulting in his presidency encompassing both market crashes. Despite this, it would be a stretch to argue that their presidencies were the reason for these booms and busts. While policies influenced these events, they had much more to do with technological and financial innovations. These and other historical episodes suggest that presidents often receive too much blame and credit for economic conditions.

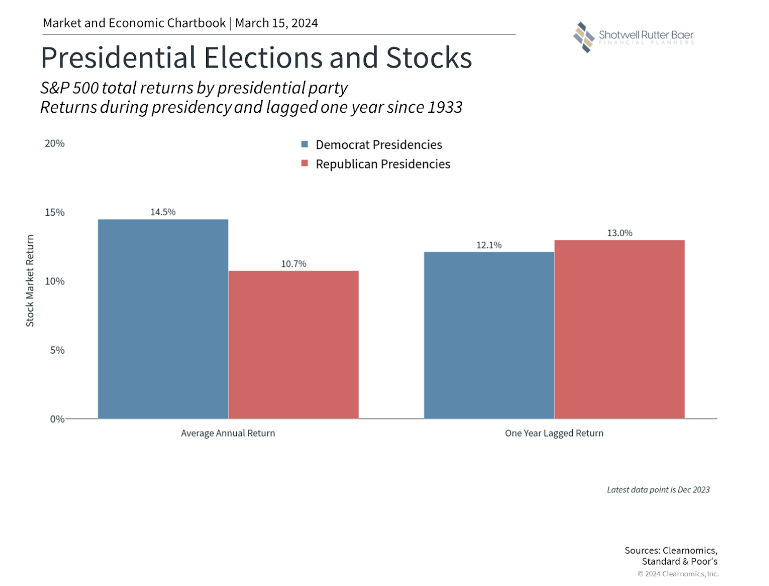

Stock market returns are positive on average across both parties

For those who are unconvinced that they should avoid day-to-day political headlines when it comes to investing, the final point is that average stock market returns have historically been positive under both parties. To underscore this point: it is not the case that markets always crash under one political party.

The accompanying chart shows that no matter how you slice it, the S&P 500 has averaged double-digit gains whether Democrats or Republicans are in the White House. Additionally, history tells us that market returns are positive on average during election and non-election years alike. While the past is no guarantee of the future, and returns in any individual year are unpredictable, jumping out of the market due to the outcome of an election, or simply because an election is occurring, is not a decision supported by history.

The bottom line? The best course of action for long-term investors is to stay balanced and not make investment decisions based on political preferences.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Share post: