Dave’s November 2023 Market Update

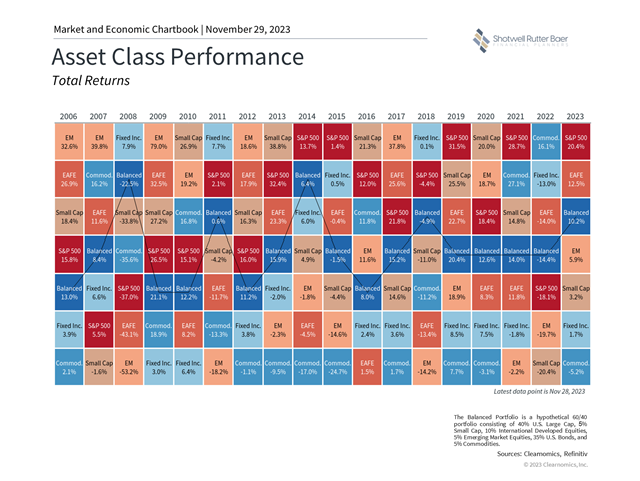

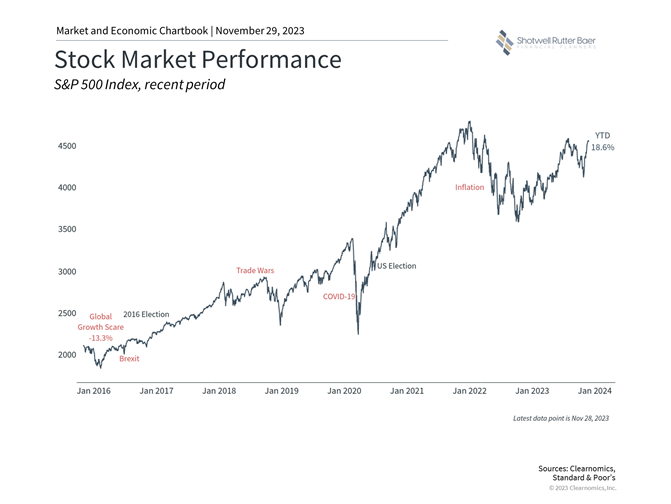

It’s Thanksgiving time, and I have plenty to be thankful for this year as always. Somewhat surprisingly I can count the economy and markets as part of that list. This has been a strange year for investors. When markets are strong, it’s not uncommon for there to be a disconnect between investor perception and market reality, and this year that disconnect seems more acute than usual. After last year’s lousy returns, 2023 has seen solid gains in the stock market with most major asset classes posting strong results as we move into the end of the year.

Throughout 2023, we have had to navigate short-term challenges from interest rate swings, inflation worries, Fed actions, bank crises, continued geopolitical conflicts in Ukraine, new conflicts in the Middle East, and political battles in Washington. When we talk to clients, the sense is that everything is lousy, and understandably so. And yet, the market has shown strong returns and the economy’s surprising resiliency.

A surprisingly strong economy has been the main driver of these returns. At the start of 2023, economists expected a recession by the middle of the year as the Fed rate hikes, implemented to fight inflation, were expected to stall the economy. Not only has the economy endured, but the job market is still one of the strongest in history with the national unemployment rate near 3.9%. Gross domestic product (GDP) growth for the third quarter, a 4.9% annualized rate, was one of the fastest in recent decades. The strength of consumer spending, driven by excess savings during the pandemic, has helped to drive the demand side of the economy as the supply side recovers. There are signs that this is gradually filtering through to corporate profits which may have reached an inflection point in the third quarter, after three quarters of falling earnings.

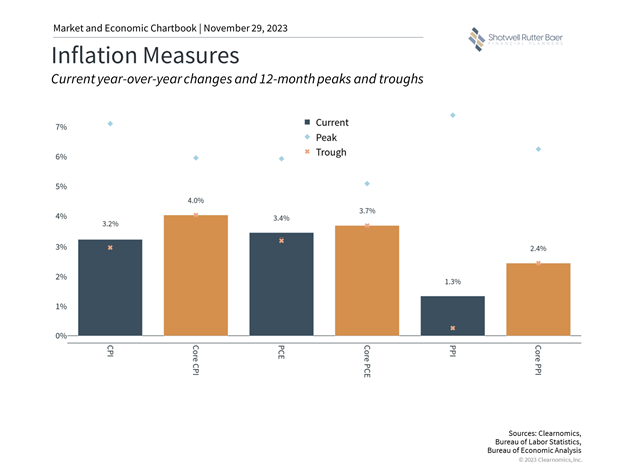

Another reason for these trends is the fact that inflation has improved significantly. Major inflation measures, such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures Price Index (PCE), are now in the 3% range on a year-over-year basis, down from highs of 9.1% and 7.1%, respectively. On a month-over-month basis, inflation improvements are even more striking with the CPI index flat from September to October. Other measures, such as the Producer Price Index (PPI) which measures inflation for businesses, have improved even more. Once again, these figures represent the rosiest scenario that economists could have predicted at the start of the year.

There’s an old cliché that a bull market climbs a wall of worry, and 2023 has illustrated that well. And none of this is to say that those worries aren’t real or aren’t still out there. We will have to wait and see what comes next. But as we close out 2023 we can be grateful that some of the worries we’ve felt all year have been held at bay and the markets have responded well.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: