Is Cash Really King?

When interest rates go up, and you can earn what feels like a decent return in bank deposits, why monkey around with stocks and bonds? After all, right now you can earn around 5% in a money market fund or lock in 5.5% for a year in a certificate of deposit while a portfolio made up of 60% stocks and 40% bonds fluctuates up and down and often seems to go nowhere but has perceptible risk. Should we just plunk our money down in the bank and ignore the market chaos?

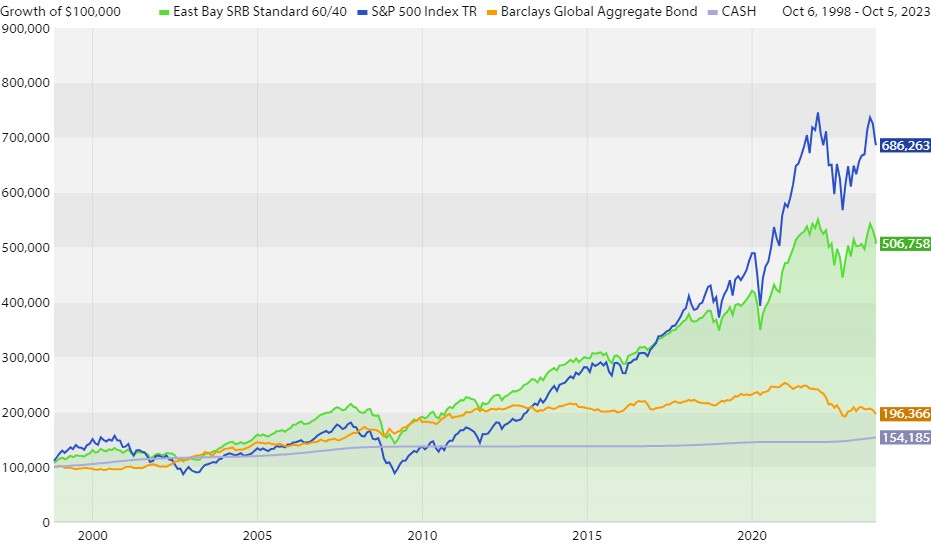

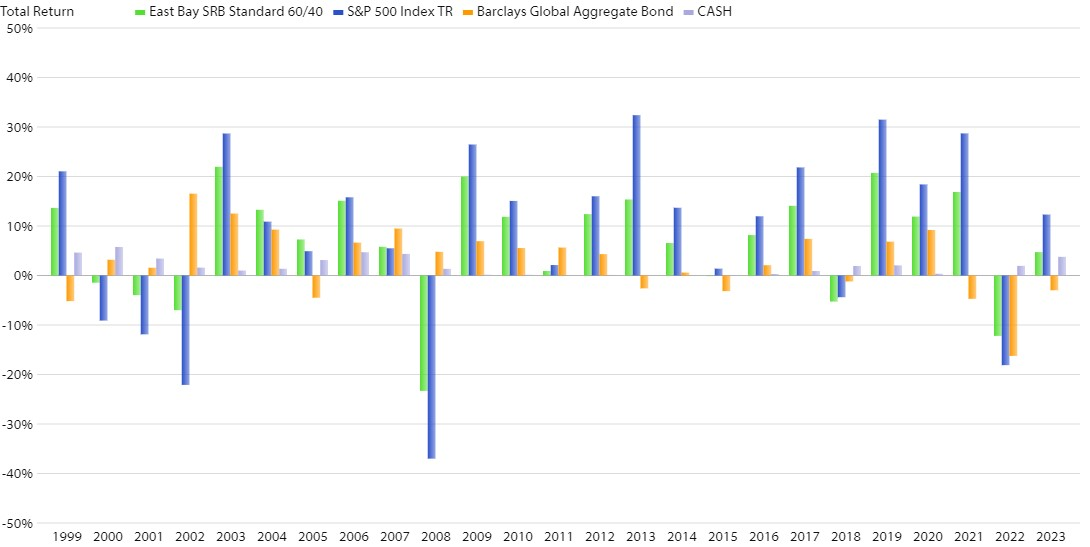

- While individual weeks, months, quarters, and even years in the stock or bond market may be negative, the long-term results are undeniable. Looking at the last 25 years, the S&P 500, for all its ups and downs (after all, that period includes the tech crash, the financial crisis, and Covid), has averaged 8%. A $100,000 investment in the US stock market 25 years ago would be worth $686,000 as I write this. Meanwhile, the aggregate bond market index was 2.73% over that period, and a balanced portfolio made up of 60% stocks and 40% bonds, grew to $506,000 and averaged 6.7% per year. How were funds placed in cash investments like money markets and certificates of deposit? The average return on cash assets over that timeframe was 1.75%, with a $100,000 growth to only $154,000.

2. Cash investments may never give you a negative nominal return (the money you make before accounting for inflation), but the real return on cash investments, when adjusted for inflation, tells a different story. According to the Bureau of Labor and Statistics website, the inflation rate over that period was 2.54% – meaning that the REAL return on cash during that timeframe was a NEGATIVE -0.79%. The last 25 years of data was a period of both low-interest rates and low inflation, but the relationship holds in periods of high and low rates and inflation. While there are periods when cash beats inflation, the overall expectation is for a negative real return over time.

3. While the current high returns on cash and the frustratingly low returns on stocks and bonds are the reason cash feels appealing, what is more important is what the current market activity means for the future. When an asset class outperforms its long-term average we expect the future returns to be lower, and when an asset class has lower returns for a period of time we would expect it to then outperform in the future. When the stock market goes down, the value of stocks relative to the earnings of the companies they represent goes up, making them more attractive, not less.

Cash holdings are an important part of every investor’s portfolio.

How much should you allocate to cash? The key to answering that question lies in the chart above: You want cash on hand to meet spending obligations in the years when liquidating stocks or bonds would mean taking losses. Generally, that means holding your current spending needs in bank accounts, along with your contingency funds for emergencies, and any funds you MAY need to spend in the foreseeable future.

When we’re talking about longer-term goals, like retirement, a bad year is far less important than the long-term compounding effect of the good years. Funds for long-term goals belong in a mix of stocks and bonds, combined appropriately for your risk tolerance, and should be left alone to fall, and ultimately rise, with the markets.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: