Our Current Thoughts on the Economy June 2023

Last month, our entire firm went through a training program to help us understand, spot, and prevent financial abuse. Financial abuse is nothing new, but in our time of electronic account access, artificial intelligence, and scammers having easy access to information, we need to be more vigilant than ever. This program was put together by AARP and provided a great background in what to look for and how to react if we believe one of our clients is the victim of financial abuse. While the program focused on elderly clients, the information was useful for all of our client relationships.

One key takeaway is that we may be the best line of defense when a client has been the victim of a scam, an email hack, or is being taken advantage of by another individual. To that end, if we see behavior out of the normal pattern or style for a client we will be following – up for verification. For instance, if a client usually calls to request distribution and we get a text instead if the wording of a request seems out of place, or we see requests for distributions, bank instructions, or beneficiary changes that don’t fit with a client’s normal requests, we will reach out and make sure the request is legitimate. While this may slow down the process or be an inconvenience at times, it is meant for your protection. While we have always been vigilant in these matters, the training program has reminded us to make it a priority.

Another step we are implementing is asking clients to add a “Trusted Contact” to their accounts. A trusted contact allows us or the custodian (TD Ameritrade / Schwab in most instances) to reach out to that person – a family member or friend whom you have designated – to express concerns if we are seeing something out of the ordinary. In general, privacy rules would prohibit this outreach. A trusted contact cannot act on your behalf- that requires they be granted power of attorney – but can offer assistance and confirmation when it is most needed and help us help our client. The government authorities made this a point of emphasis only recently and custodians responded by providing a form that allows for us to add a trusted contact whom we can talk to without violating privacy rules. Some newer clients already have this in place. For those who don’t, we will be bringing it up in our next round of meetings to give you the opportunity to name someone.

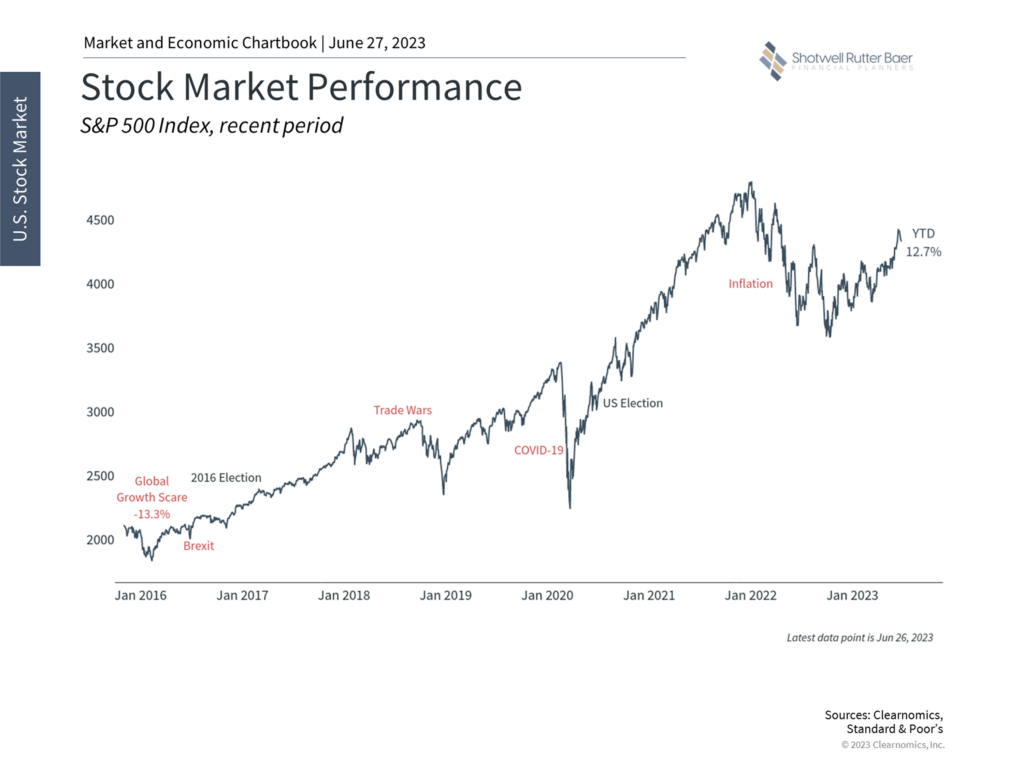

Earlier in June, the S&P 500, which measures the performance of the 500 largest American stocks, entered a new bull market. That means the index has risen more than 20% from its lows reached in mid-2022. This news comes as a surprise to many people with whom we talk, and indeed the market’s performance so far this year has caught many analysts and professional investors by surprise. So far, the severe slowdown/recession that most economists were predicting for 2023 has not materialized, at least not yet.

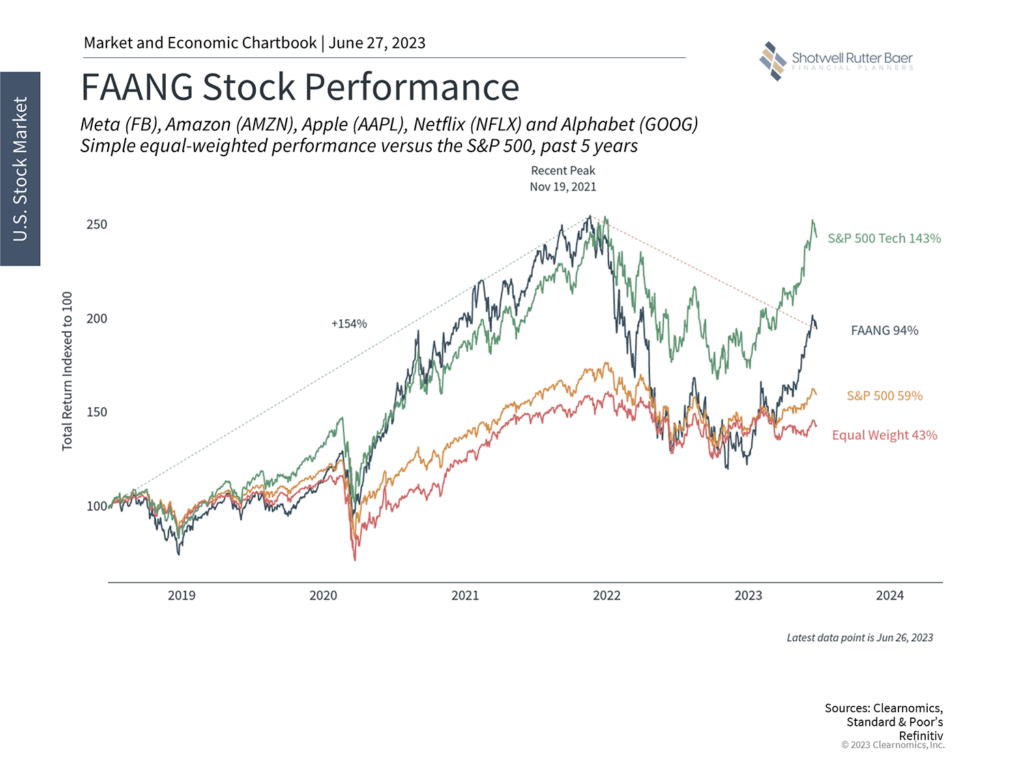

One reason the current market rally seems to lack credibility is that the surge in the indices has been driven by only a handful of large tech companies. While companies like Apple and Nvidia have been surging since early this year, the average stock in the S&P 500 is flat or negative for the year. This surge in tech has been attributed to the attention being paid to artificial intelligence, but probably also owes something to the idea that rate increases, which hurt tech companies, may be drawing close to an end. Also don’t forget that tech was one of the worst sectors in 2022, and these things tend to work like a pendulum. While a narrow rally like this is a cause for concern and makes the market increase seem fragile, that can change. If investors truly feel bullish, we’ll start to see the rest of the market follow suit and the rally will broaden.

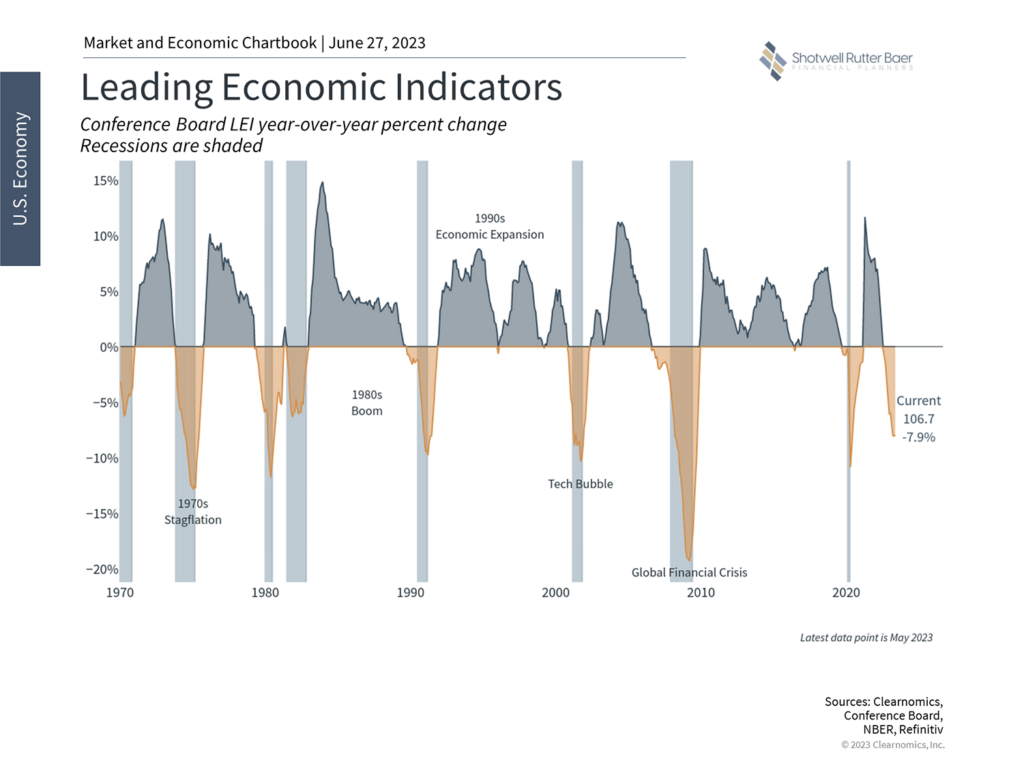

Meanwhile, the index of leading economic indicators, a group of economic data that helps read what direction the economy is heading, now shows signs that growth is slowing. On the one hand, this is good, as the Federal Reserve has been increasing interest rates steadily in order to create that slowdown and bring inflation under control. On the other hand, we’d all feel better if inflation abated without a recession.

Keep in mind that an economic recession, if it happens, may already be built into the market’s current levels. The market is not the economy and vice versa, though the two are obviously intertwined. The market has already priced in an economic slowdown – the question is whether it is priced in enough of a slowdown or too much. Time will tell and we will continue to focus on the long term.

Keep in mind that an economic recession, if it happens, may already be built into the market’s current levels. The market is not the economy and vice versa, though the two are obviously intertwined. The market has already priced in an economic slowdown – the question is whether it is priced in enough of a slowdown or too much. Time will tell and we will continue to focus on the long term.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: