Our Current Thoughts on the Economy May 2023

Every year in late spring, Warren Buffett’s company, Berkshire Hathaway, holds its annual shareholder meeting on a Saturday. This was the first year I’ve actually watched the proceedings (it was raining, and I was on crutches anyway), and they were fascinating. One attendee passing by a CNBC camera on the floor of the event described it as the “Woodstock of the investing world,” and I think that was an apt description. Attendees ran the spectrum from Wall Street executives to middle-class retirees and many had traveled great distances to hear Warren, and his long-time partner Charlie Munger, speak and answer their questions from the audience. The halls outside the main auditorium were lined with booths from the various companies in which Berkshire Hathaway has a stake, from See’s Candy to Geico Insurance.

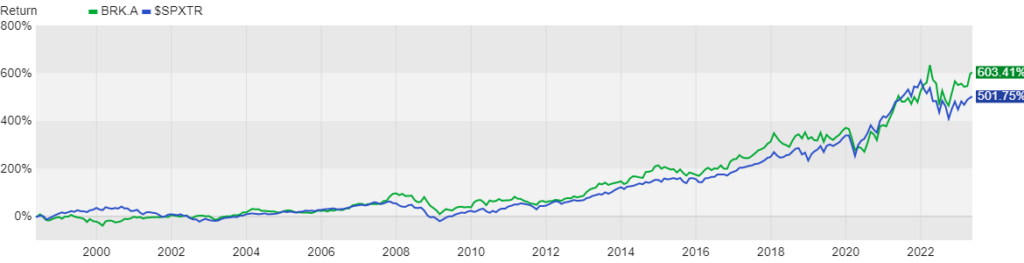

25-year chart of Berkshire Hathaway Stock vs. S&P 500

It Looked Like a County Fair

Buffett and Munger talked about the current state of banks, artificial intelligence, commercial real estate, and the role of the dollar as the world’s reserve currency. I won’t go into all the details (if you are interested, CNBC has the full event available on their website), but my impression was that the dean of American investing was as calm and unflappable as always in the face of an uncertain world. I was reminded of how in the midst of the financial crisis his company and his capital helped stabilize the banking system during an existential reckoning. Buffet has been wrong and made mistakes in his storied career, but his ability to see through the short term and bet on the future is the stuff that has made him a legend.

How to Avoid Mistakes

My favorite part of the event was when a young man in the audience asked Buffett how to avoid mistakes. “Write your own obituary, then try to live up to it,” was his first reply, followed by a reminder to not “make investment mistakes that will take you out of the game by taking too much risk.” Try to never have a night when you worry about your investments.” And, more music to a financial planner’s ears: “Spend a little bit less than you earn,” because otherwise, you will accumulate debt you may never pay off. He does make an exception for a home mortgage. Lastly, he reminded everyone that he had “Never known anyone who was basically kind who died without friends, but I’ve known plenty of people with money who died without friends.” Powerful stuff from a man who continues to be so different than the stereotype of Wall Street money managers and corporate moguls. And he continues to teach them how the game should be played.

Raising the Debt Ceiling

As I’m writing this, the threat of the US Treasury defaulting on its obligations seems more real than at any other point in my career. Republican leaders in Congress are in a standoff with President Biden over raising the debt ceiling. Republicans are arguing that any agreement to raise the debt ceiling be tied to reducing future spending, while their counterparts are in favor of higher taxes rather than reduced spending. Hopefully, by the time you are reading this, the deadlock has been resolved. Last week, we posted an article from Clearnomics that explores what the Debt Ceiling is and how it may impact investors in the longer term. The stakes are high: not raising the debt ceiling means a default on US debt, and the long-term economic implications of a US default are scary.

Related: What the Looming Debt Ceiling Deadline Means for Investors

What do we do in the short term?

No doubt the stock and bond markets are going to be volatile as Congress and President Biden fight over their positions. In the end, we expect that they will reach an agreement, even if it only kicks the can down the proverbial road. While moving money out of stocks and into less-volatile assets may have its appeal, timing such moves is nearly impossible and in the long – run we would expect lower returns by doing so. As with any other headline-grabbing threat, the best bet is to stay committed to our long-term portfolio plans. We need to differentiate between making people feel better by reducing short-term volatility and making our clients actually better off in the long – run by ignoring the immediate ups and downs.

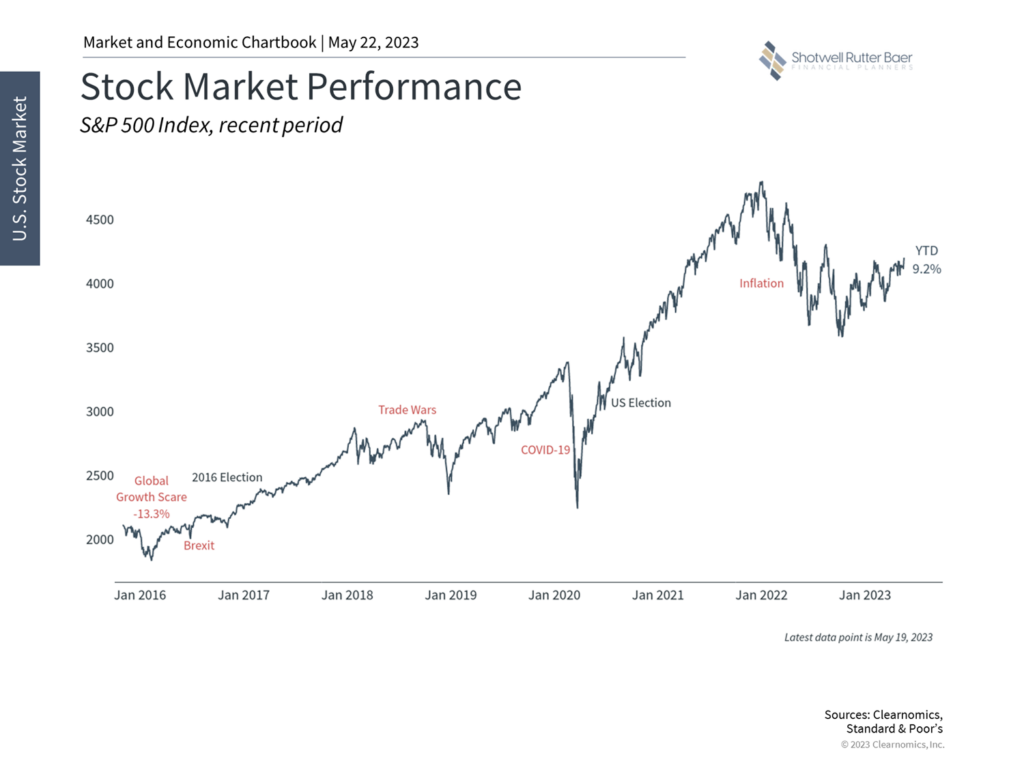

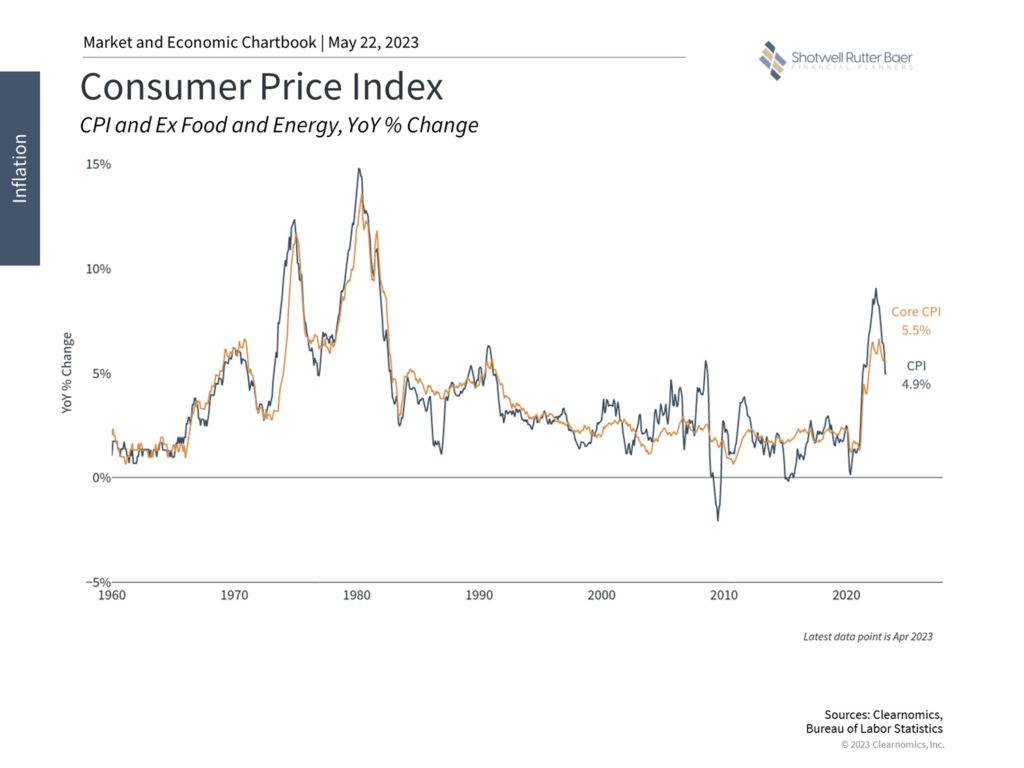

Meanwhile, the stock market has been doing pretty well, with the Stand and Poor’s 500 Index up over 9% year to date as I write. The Federal Reserve’s campaign against inflation seems to be taking effect, with the Consumer Price Index coming in at 4.9% for April. We’re still waiting to see whether the Fed can continue to bring inflation down without slowing the economy too much, the “soft landing” that economists are looking for. So far so good, as unemployment remains very low, consumer spending is strong, and corporate earnings are better than expected for this quarter, but this issue will no doubt be front and center again once we move on from the debt ceiling.

Please feel free to contact us with your questions or if you are looking for a financial advisor.

Please feel free to contact us with your questions or if you are looking for a financial advisor.

Call us at 517-321-4832 for financial and retirement investing advice.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.