Presidential Election and Markets

There is no escaping this year’s Presidential election. Every television commercial, every spam robocall, every inch of our neighbor’s yard, reminds us that we must vote in November. As we meet with clients for reviews this fall, the question of what the election will mean for the markets and the economy looms in the background. There is no avoiding it.

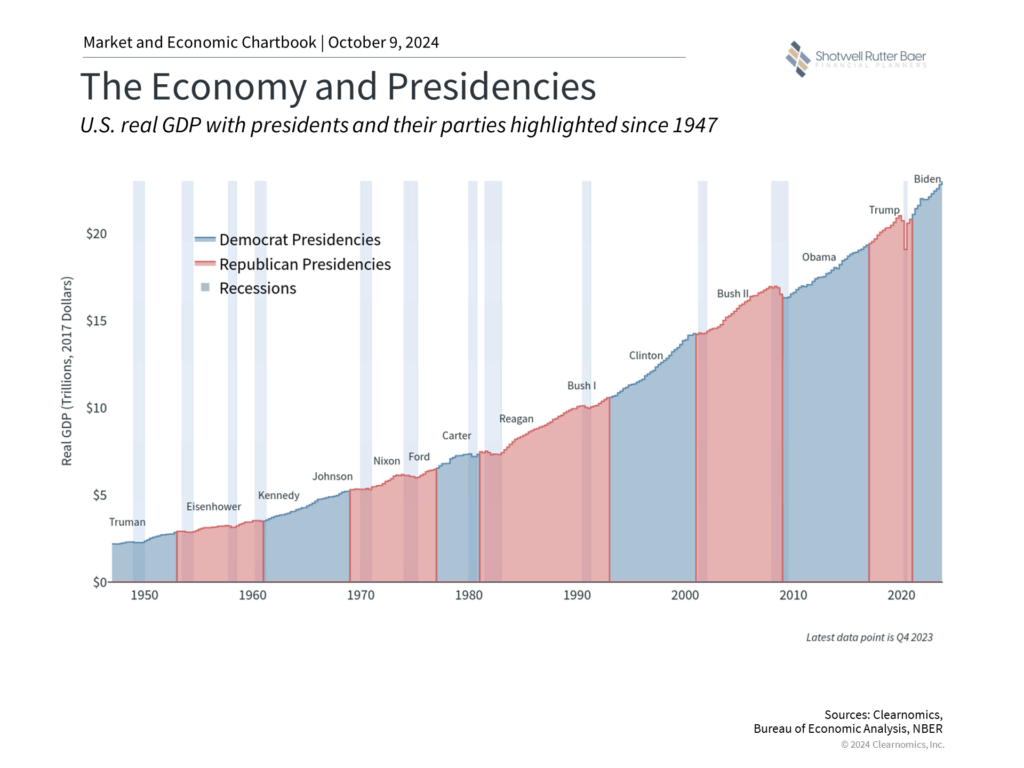

We’ve posted articles on this topic and talked about the election on our podcast more than once this year. History suggests that the economy does not care who the president is, or which party controls the White House. The economic cycle is far more than the party in power, and despite what we think, government policy only affects the economic cycle on the margins. As this chart reminds us, the economy, as measured by gross domestic product, has grown steadily since World War II despite regular changes in party leadership.

This May Seem Counterintuitive

After all each election cycle both parties claim the other’s policies will mean disaster for the economy. While different tax and regulatory environments may influence the economy on the margins, the business cycle is driven by factors largely beyond politicians’ control.

This is particularly true when it comes to the American President. While good economic cycles and bad are tied to the president in office, and their electoral fate is often decided by our perception of the economy under their leadership, in truth they rarely can act on the policy initiatives that they proclaim during their campaigns. They cannot change the tax code without congress, and while they can affect how regulations are enforced by government agencies, they cannot create new ones or eliminate regulations they do not support. The president does have more latitude in imposing tariffs based on current law, but Congress pushes back on that ability as well.

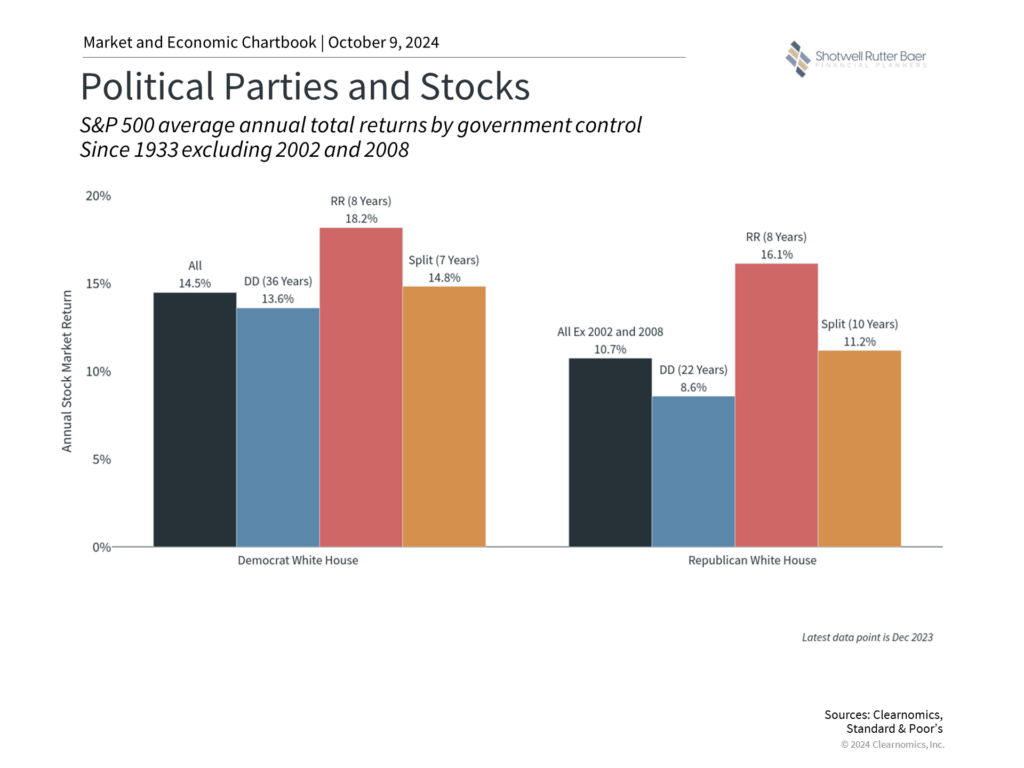

Ironically, while Americans tend to hate gridlock, the market embraces it. If we think of the stock market as a tool for predicting the future value of corporations, this makes sense. When we have divided government, the rules don’t change – tax law and regulations stay stable – and predicting future corporate profits is easier. As this chart shows, the best returns for the stock market have coming when a Democrat was in the White House, but Republicans controlled the House of Representatives and the Senate.

I’ve been asked which candidate’s policies might be better for the markets. Neither candidate’s proposals offer much to suggest they’d be good or bad for the overall economy or the markets, even if they are able to implement those proposals. Certainly, there is little to suggest that we should steer our portfolios one way or the other.

The Bottom Line

It is very important to vote for what you believe to be the best choice for our country. But vote with your ballot, not your portfolio as the market will likely not care who wins the election. And remember that no matter what happens in November, approximately half of your fellow citizens will be disappointed. We should all reflect on why that is and what we can do to improve our democracy.

Do you have questions or concerns about this? Email us at info@srbadvisors.com. We’d love to hear from you.

If you like this article, check out my series at The Street here.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: