S3E33 – Dealing with Investment Fraud in Retirement

Podcast: Play in new window | Download

In this episode, we tackle the alarming rise of investment fraud targeting retirees. Cole Willams joins us again to discuss the increasing prevalence of scams, driven by economic hardships and advanced AI technologies, and offer practical advice on protecting your finances from fraudulent schemes.

Key Points Covered

Introduction to Investment Fraud

- The Internet age has brought numerous types of scams and fraud.

- Retirees are targeted more frequently than other demographics.

- The importance of discussing these issues to prevent financial loss.

Common types of fraud include:

- Cryptocurrency

- Foreign exchange

- Guaranteed buyback

- Precious metals

- Commodities trading

- Real estate

Current Fraud Statistics

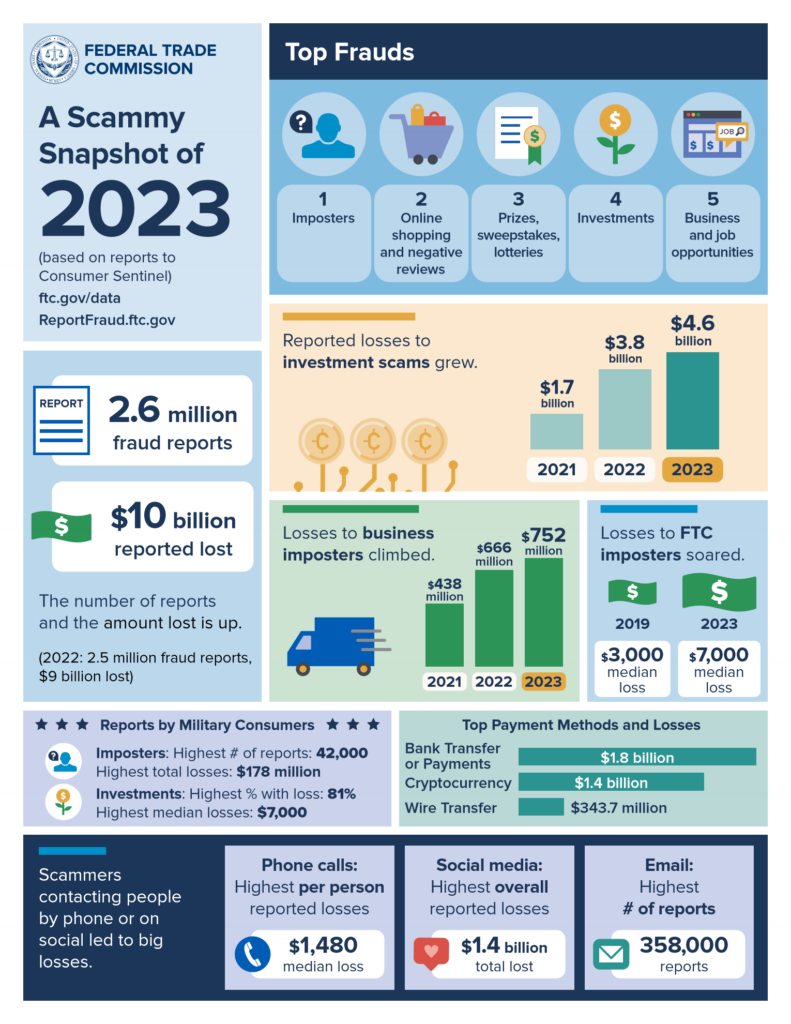

- A recent Federal Trade Commission report shows 2.6 million fraud reports with $10 billion in reported losses in 2023.

- Economic hardships and advancements in AI contribute to the rise in fraud cases.

AI’s Role in Modern Scams

- AI tools like ChatGPT can generate convincing scam scripts, eliminating the telltale signs of broken English.

- AI can also create realistic fake voices, making phone scams more convincing.

- Example of Google AI’s ability to conduct natural conversations, highlighting the new risks.

Political Donation Fraud

- Scammers use AI to impersonate well-known political figures, such as President Trump, to solicit donations.

- Tips to avoid fraud: verify legitimacy by calling official numbers or donating through trusted channels.

General Scammer Tactics

- Pressure tactics: creating a sense of urgency to act immediately.

- Emotional manipulation to get victims to act against their better judgment.

- Importance of recognizing these tactics to avoid falling victim.

Identifying Common Scams

- Scams often involve threats of legal trouble or promises of prizes that require immediate action.

- Legitimate organizations will never pressure you to act within a short timeframe.

The Scale of Modern Scamming

- Scamming has evolved into a multi-billion dollar global industry, with organized call centers and advanced technology.

- Understanding the organized nature of these operations can help potential victims stay vigilant.

Why Retirees are Targeted

- Older individuals are often seen as easier targets due to cognitive decline and greater wealth.

- Younger people are also falling victim, indicating that fraud is a risk for all age groups.

Tips for Protecting Yourself

- Be cautious of unsolicited calls and emails.

- Verify information by calling official numbers.

- Avoid sharing personal information with unknown callers or online sources.

- Check credentials

- Look for transparency

- Take your time

- Get a reality check

- Know your limitations

Resources

5 Ways to Prevent Elder Financial Exploitation

Americans Reported Losing a Record $10 Billion to Scams and Fraud in 2023

Conclusion

Investment fraud is a growing concern, especially for retirees. By understanding the tactics used by scammers and staying vigilant, you can protect your hard-earned savings. For more detailed advice and personalized guidance, consider consulting with a financial planner.

Stay informed and protect your investments. Subscribe to our podcast for more tips on safeguarding your financial future. If you have any questions or need assistance, don’t hesitate to reach out to our team of experts.

Thank You for Listening!

Don’t forget to subscribe, rate, and review our podcast on your favorite platform. Your support helps us reach more listeners and provide valuable information to protect your financial well-being. Check out our YouTube Channel HERE

Share post: