S5E2 – 4th Quarter 2025 Review and Market Outlook

Podcast: Play in new window | Download

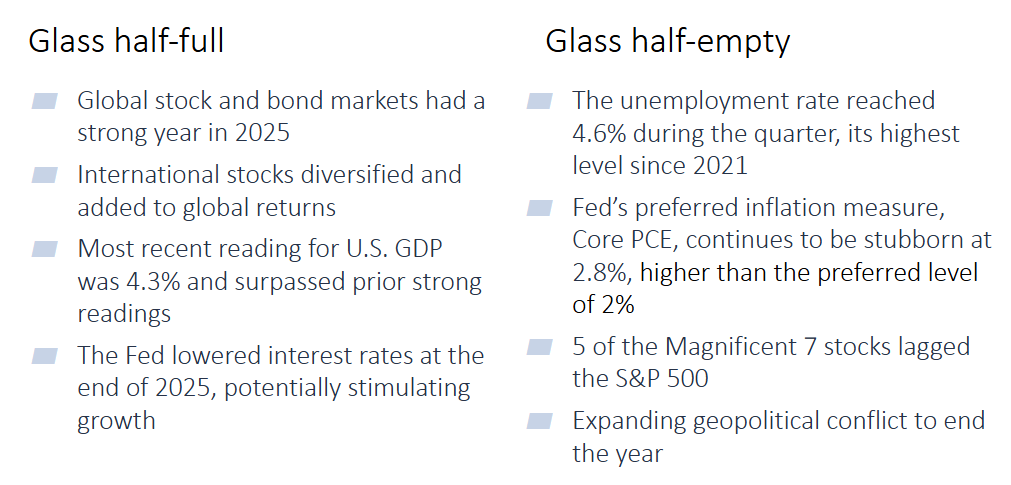

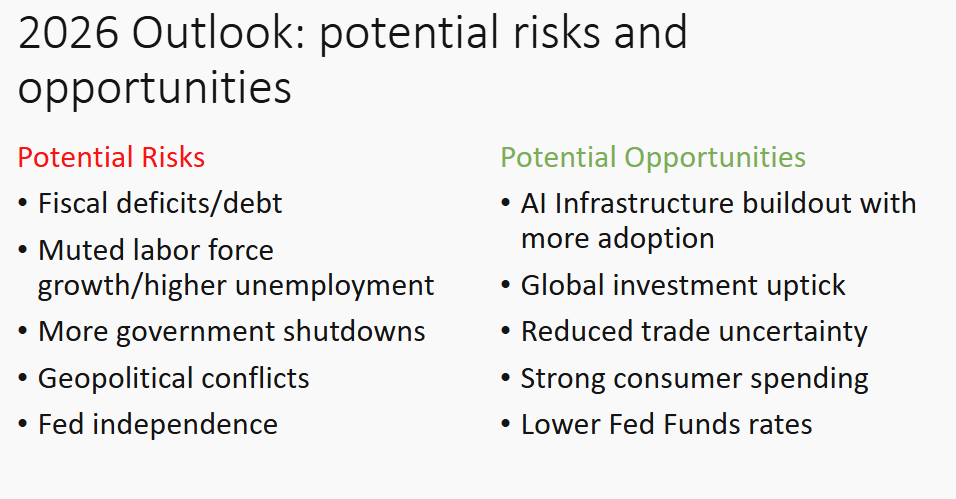

In this quarterly recap, David Shotwell and Nick Nauta look back at how markets finished 2025 and share what they are watching in 2026. They cover the spring volatility that tested investor patience, why diversification mattered again, and how a traditional 60/40 mix held up. They also share a balanced “glass half full, glass half empty” view of the economy, then close with the main risks and opportunities for the year ahead.

There were important investment lessons to be learned in 2025: First, the year saw extreme volatility, with big gains to be had for those who could stomach the ride up, down, and back up again. Investment discipline was the key to another great year of returns. The length of time between the worst daily performance for the S&P 500 and the best was only five days. Reacting to the market turbulence in early April, as the market responded to quickly – shifting trade policy out of Washington, would have meant missing out on the fast recovery and positive market run that followed.

The second lesson of 2025 was the value of diversification. While the S&P 500 returned over 17% for the year, the leaders driving that return shifted, with only two of the so – called Magnificent Seven tech stocks outpacing the broader market. Betting on a narrow sector of the market can lead to missed opportunities. Further emphasizing the lesson of diversification, after several years lagging US markets, 2025 saw significant outperformance from international markets with developed international and emerging market indices ending the year up over 30% and boosting portfolio return significantly.

As we move into 2026, the economic signals remain strong, but the signals are mixed. Economic growth, as measured by gross domestic product, has been robust, but the labor market, while still strong, shows signs of weakening. Meanwhile, inflation has remained moderate – higher than the Federal Reserve’s goal of 2% but remaining below 3% despite concerns that tariffs and government spending might cause a spike.

As usual, our portfolio advisors at East Bay Investment Solutions prefer to take a balanced approach to market guidance, and their Glass half-full / Glass half – empty chart is below. You can download their full commentary and deep explanation of the issues outlined above here or click here if you prefer to watch their recorded presentation.

Main takeaways

-

Discipline mattered in 2025. A sharp early April drop was followed by a fast rebound, and the year still finished strong.

-

Diversification paid off. International stocks delivered strong results, and most “Magnificent Seven” names lagged the broader S&P 500.

-

The economy sent mixed signals. Growth was strong, while unemployment moved higher and inflation stayed above the Fed’s target.

-

The 60/40 is still relevant. A balanced stock and bond mix produced a strong year with less volatility than an all stock approach.

-

For 2026, stay focused on what you can control. Markets will have risks and opportunities, and your plan should be built for both.

What we cover

-

Why 2025 rewarded patient investors

-

The case for owning international stocks

-

Stock market breadth and the shift away from a narrow group of mega cap tech leaders

-

GDP strength, unemployment trends, and why inflation can feel different than the official number

-

60/40 portfolio results and risk adjusted returns

-

2026 risk list: deficits, geopolitics, labor shifts, shutdown risk, and Fed independence

-

2026 opportunity list: AI investment, steadier trade policy, consumer spending, and possible rate cuts

Charts mentioned (for reference in the episode)

-

S&P 500 drawdown and rebound around early April 2025

-

Rolling 12 month leadership: US stocks versus international stocks

-

2025 performance: S&P 500, international equities, and bonds

-

Magnificent Seven relative performance versus the S&P 500

Want to know more?

Contact SRB today at 517-321-4832 or email us at info@srbadvisors.com.

Don’t forget to subscribe to our channel for more bite sized financial and retirement tips. https://www.youtube.com/@shotwellrutterbaer