Three Reasons for Investors to be Thankful This Year

Podcast: Play in new window | Download

Saying it’s been kind of a rough year might be the understatement of the century. It has been a rough year in the markets.

In a year when we’ve been fighting inflation, the feeling on the street is just overwhelmingly negative. All of these things can feel like a crisis. The US economic market has endured countless crises but it continues to grow and flourish and the markets are humming along with it.

The Long-Term Stock Market

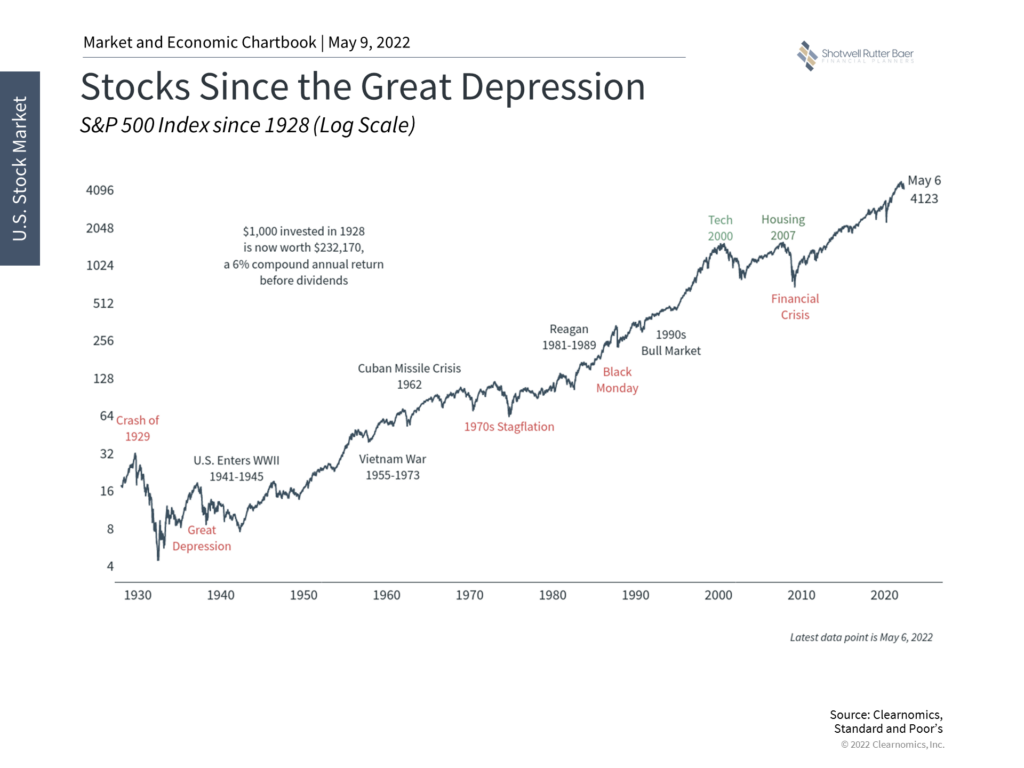

This chart shows:

- the tech bubble crash

- Black Monday 1989

- The stagflation of the seventy

- The Cuban missile crisis

- The Vietnam war

- World war 2

All these things felt like the end of the world at the time. Well, the end of the financial world, anyway. There are a lot of events that didn’t make the chart. Yet the stock market still continues to grow.

So, a little inflation and supply chain issues and stuff coming out of the pandemic seems pretty important right now but probably will be a blip in the chart in the future.

Thinking beyond the stock market in general, and thinking about life, there are always bad things that are going on and oftentimes we fail to put them into perspective.

If you think of all of the great things that have happened in the last five to 10 years, it’s really a remarkable time that we live in.

Thinking about the stock market in the long term, we are not so worried and we don’t tend to focus on the bad of what’s happening right now at this moment.

Record Low Unemployment

Despite concerns about the economy, the unemployment rate, which underpins that economy and keeps money in people’s pockets, is still at record lows. We’ve got a 3.7% unemployment rate. How bad can a recession be if everybody still has a job?

The definition of a recession is when your neighbor loses his job. A depression is when you lose yours. So far, very few net people have lost their job.

There have been quite a few layoff announcements out in Silicon Valley. A lot of tech companies are laying people off. But the net numbers as of this morning show the creation of another 200000+ jobs in October.

It is remarkable that despite inflation and companies tightening their workforce, we haven’t seen things change in terms of unemployment rates and unemployment in general.

According to The Wall Street Journal, it looks like we have a 5.1% wage growth. So, not only are people continuing to hold onto their jobs but they’re also getting a decent raise. Keep in mind, inflation over that same timeframe was in the 8-9% range, but it takes some of the sting out.

Another thing to keep in mind regarding the tech jobs, some of the pundits have put it out there that really what happened was during

the pandemic many companies overhired because they were worried about having capacity as more activity moved online.

Now things are reverting to normal as far as that goes so we’ll see how it plays out. It sounds like it’s almost more of a cyclical thing that happens in tech

Fixed Income

With higher interest rates the bond market has come down a bit. There’s actually income in fixed income these days. Imagine that right? Not only income and fixed income, but we’ve also seen cash savings rates get a little bit of rate of return as well.

those bond funds.

Another thing that’s been extremely hurtful is that at the same time the bond market interest rates are rising bond prices are going down.

The stock market is also down.

Not only do you need to eat your vegetables, but you got to go to bed early too and get that extra rest.

Conclusion

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.