Worsening Inflation, Consumer Sentiment, and the Markets

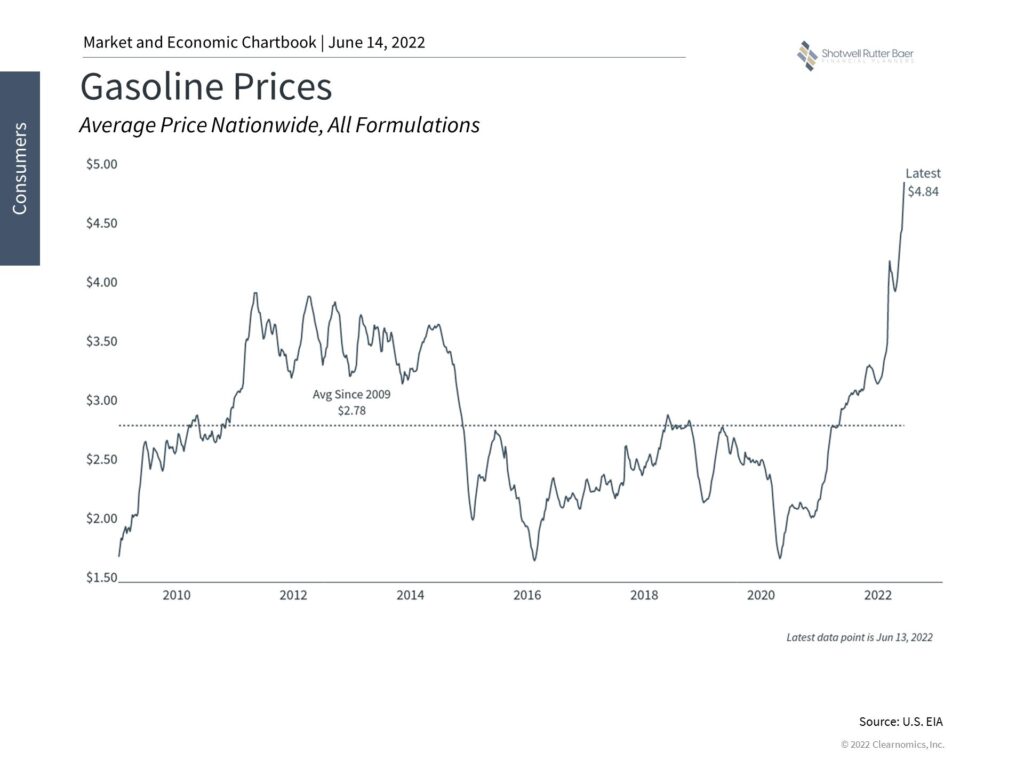

The last two years have created a perfect storm for inflation. During the Covid Pandemic, most of the economy came to a full stop, disrupting the production of goods and materials. As the economy reopened, demand surged while production had not caught up. The pandemic also led to changes in the workforce that have led to a very tight labor market where companies must pay higher prices to compete for workers. The war in Ukraine has exacerbated the problem, disrupting Russia’s gas production and Ukraine’s food production.

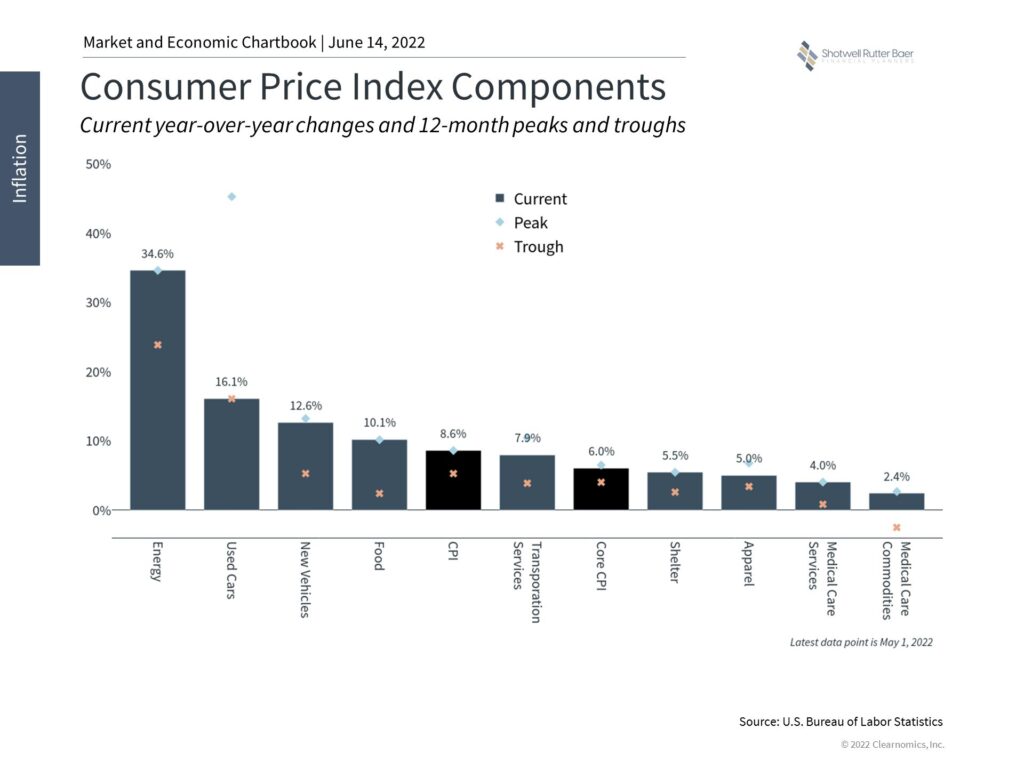

Last week’s reading of the Consumer Price Index, the most common inflation gauge, accelerated again in May to 8.6%, the fastest growth rate since December 1981. This has pushed both the stock market and bond market lower since the start of the year, with the S&P 500, the broad measure of large US corporations, entering bear market territory this week. With inflation front and center for investors, there are two broad areas of concern.

First, the Federal Reserve is in the process of raising interest rates to slow the economy down and bring inflation under control. Investors worry that the Fed’s action will induce a recession, slowing the economy too much. This is what happened during the early 1980s: by tightening monetary policy, the Fed was able to control inflation but only at the expense of economic growth. The policy worked, setting the stage for the subsequent growth of the later 1980s and 1990s, but was very difficult at the time.

While the parallels to the late 1970s and early 1980s can be instructive, there are important differences between that period and today. Inflation was much more persistent throughout the 1970s, and the Fed was slow to act. The Fed today has already started the process of tightening policy through higher interest rates and thus avoiding the drastic increases that started in 1979.

Additionally, we are starting from a very different place compared to 1979: Underlying demand in the economy is still strong and unemployment is near historic lows, while the rate increases in 1979 and the early 1980s came after a long period of spiraling inflation and a weak job market. If supply can catch up with demand while the job market stays relatively strong, the outcome may be much better.

The second inflation concern weighing on the market is that rising prices will harm the consumer and corporate spending. We are already seeing signs of this pressure in this quarter’s corporate earnings reports. Necessities, including food, shelter, and gasoline, are now significantly more expensive compared to last year. These high prices are impossible for households to avoid, leaving families with less to spend on other goods and services.

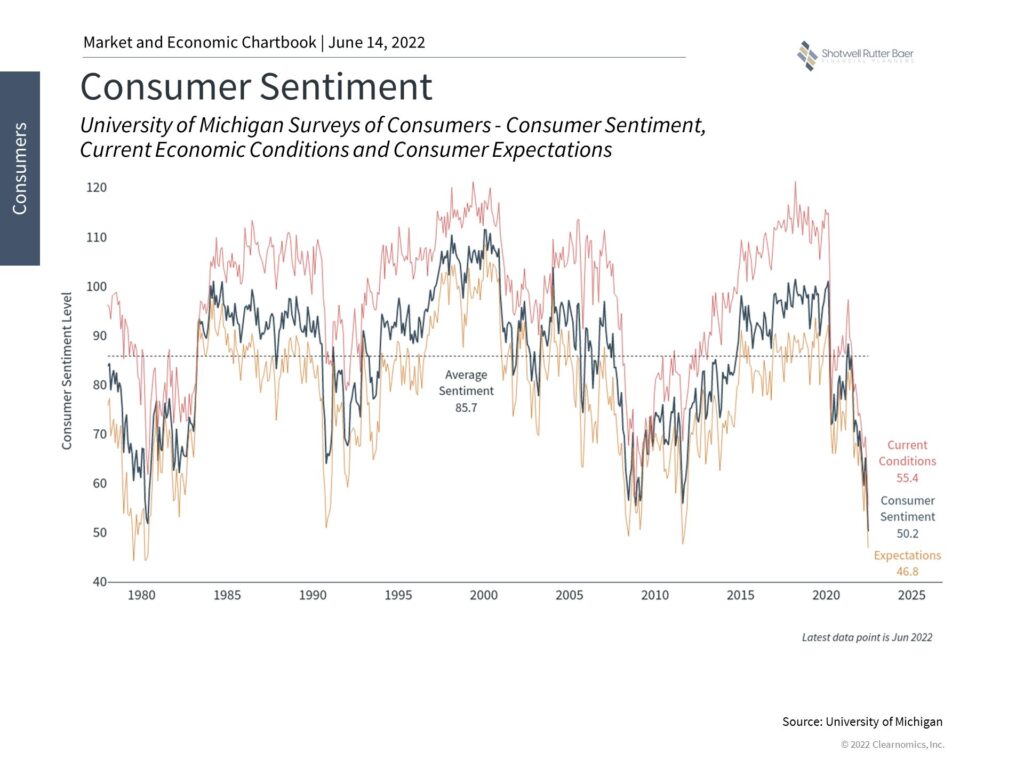

The inflation pressure has added to consumers’ financial stress. The University of Michigan’s measure of consumer sentiment is now at its lowest level in the history of the index. This measure directly correlates with consumers’ expectations of inflation, which in turn reflects the inflation they have already seen and experienced.

While consumer sentiment is an important measure of the economy, is entirely BACKWARD looking, based on elements that have already impacted the economy. For this reason, consumer sentiment tends to be a CONTRARIAN indicator for the market: the best time to buy and hold is when consumers feel the worst. Once the underlying stress begins to fade, consumer sentiment improves, and the markets rebound. This is exactly what took place in the early 1980s as inflation began to dissipate.

What does all this mean? The path of the markets in the short – term will depend on the path of inflation. The Fed is working to slow the economy without making the problem worse, but many of the underlying issues, including supply shocks from Covid and the war in the Ukraine, are beyond their control. If these issues are resolved, and the largest price shocks are behind us, we should see inflation measures start to turn around. If inflation stays high for a longer period, there may be a larger impact on corporate profits. Either way, with consumer sentiment so low the recent market declines may mean that the worst-case scenario is already baked in leaving more upside than downside.

As always, the best course of action is to remain disciplined and not try to guess the direction of inflation or how the market will react. While this is the first time in four decades that inflation has been an issue, investors have faced many market challenges over the past several years. Staying invested in a diversified portfolio that matches your long–term financial plan remains the best option.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: