Bull and Bear Market Cycles

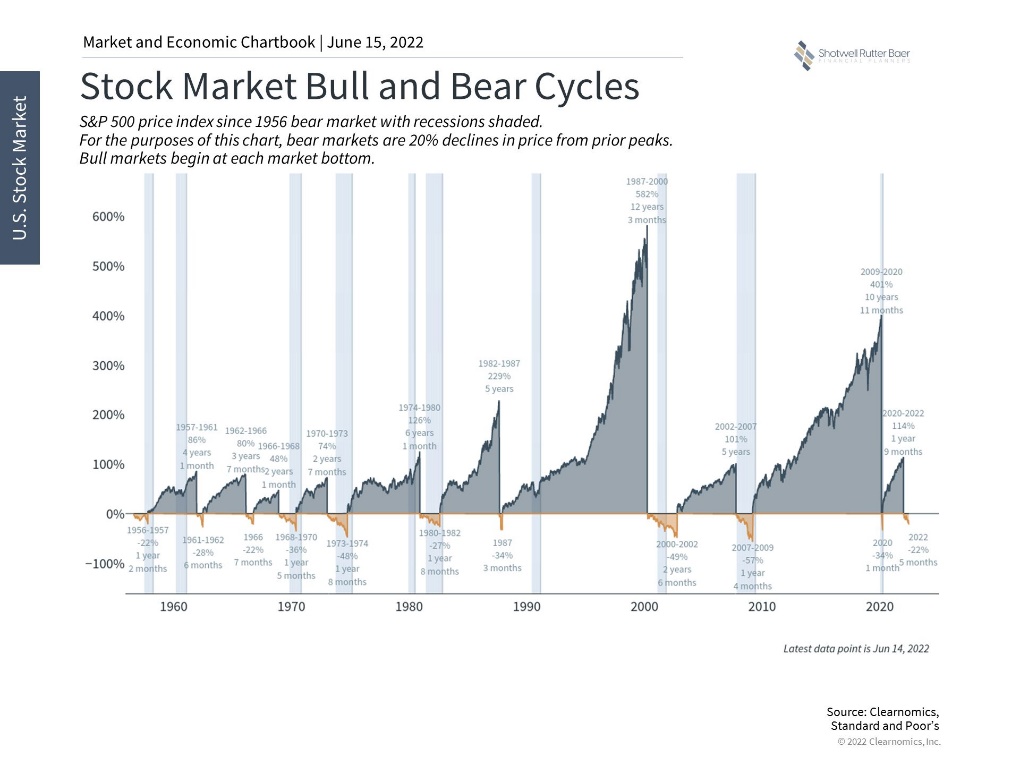

As of last Monday’s market close, the S&P 500, the stock index for the largest American companies, entered bear market territory, meaning that it had dropped 20% from the high it posted in December 2021. Several headlines have been talking about the market entering bear market territory. I thought it might be helpful to explain what constitutes a bull market and what makes a bear market and provide some historical context.

- The market is said to be a bear market any time a market index drops 20% from its recent peak. A bull market occurs any time the index rises 20% from its most recent bottom.

- These terms don’t provide any predictive power or mean anything beyond those simple definitions. When we hear that a market enters a bull market cycle or a bear market cycle, it tells us nothing about how high or low the market might go or how long the current cycle will last.

- Try as we might, there is no way to know when one market cycle starts and the previous market cycle ends.

- While we can’t predict the cycle, history shows us that bull market returns are much more positive than bear markets are bad, and bulls tend to last much longer than bears. Since 1956, the average bear market has lasted one year and two months, with a decline of 36%, while the average bull market has lasted 5 years and 9 months with an average return of 192%.

- The key to remaining calm during a bear market cycle is remembering that the gains of bull markets have always made the losses of a bear market worthwhile and remaining invested during the bear market is the best path to long–term success.

- This chart compares the longevity and gains of bull markets to the longevity and losses of bear markets, going back to the 1950s. The magnitude and duration of bull market runs have always outweighed the setbacks of bear markets.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: