Financial Goals for 2022 – Things to Consider NOW

Podcast: Play in new window | Download

Have you set your financial goals for 2022?

Dave and Nick go over many things that you should be thinking about this month to set yourself up for a great financial year in 2022. Even if you do have goals, you might find some gems in this episode that you didn’t think of. Saving money, investment strategies, tax considerations, and more.

Please share this episode with someone you know who could benefit from this advice! They will thank you.

Look at 2021 Goals

How much did you accomplish last year? Give yourself a pat on your back and appreciate what you did. What worked out well in 2021? Can you use these strategies in 2022? The markets did really well in 2021 – how is your portfolio?

Set New Financial Goals for 2022

Be realistic and come up with 1 -2 priorities. Get your retirement plan in shape. Pay down credit cards. You will have a much better time reaching your goals if you break them down and have a select few that are really important.

Life Events

Moving, marriage, births, retirement, starting or ending college, changing jobs, and more. The more you can identify and prepare for these events, the better you can set yourself up financially. The more prepared you can be the more successful you can be.

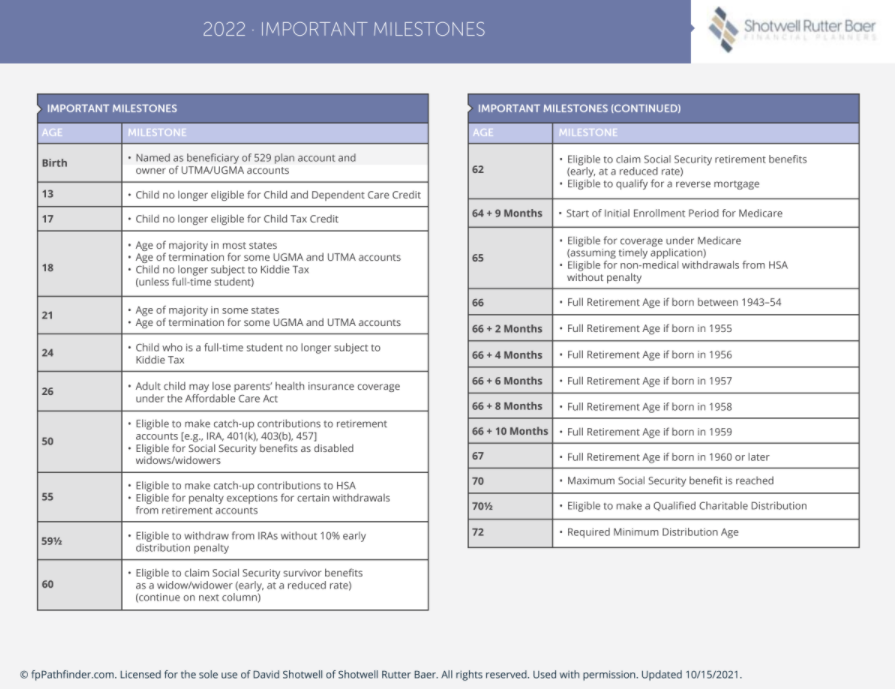

Milestone ages are important in your overall financial plans. Check out the list below to discover which ones are coming up for you or your family members.

Budget & Cash Flow

Are your income and expenses in flux and changing from last year? It is a good idea to review these things in January. You may get a raise, health insurance expenses may arise, and other changes.

Employee Benefits

Also, review your employee benefits to make sure you are taking advantage of all that it has to offer. If you are unsure, our financial advisors at Shotwell Rutter Baer can help you sort through it and figure out the best plan with the options you have. HSA or FSA accounts and other things are good to review at the beginning of the year. If you have funds left in these from 2021 you may have a limited time to use them. These are plan specific and some will allow you to carry over to the next year.

IRA Contributions

Does it make sense for you to make a contribution for 2021 to offset your income and tax obligations? You have to April 15 most years to make that contribution for the previous year. If you are subject to required minimum distributions be sure you take out the minimum before the end of the year. Even if you plan on taking it out later in the year, it is good to have a plan now and set reminders to make sure you do it on time.

Savings Goals

Are you saving enough toward retirement? Are you saving for things that will make 2022 exciting? A vacation. Home renovation. Other things that will make 2022 important to you. Figure out how much you need to set aside each month to make these things happen.

Emergency Funds

Do you need to replenish or adjust your emergency fund? Do you anticipate a job change this year? Health issues? Or other things that may require you to pad your emergency fund. The sooner you start this the easier it is to build it up.

Major Purchases

Are you thinking of buying or selling real estate? A business? Shares? Any major purchases or sales could have tax implications that you should plan ahead for.

Investment Risk Tolerance

Is your risk tolerance where it should be? Do you want to take more or less risk based on your financial goals for the year? Your risk tolerance is a big factor in considering life milestones.

Review reasonable benchmarks for your accounts and go over them with your financial advisor.

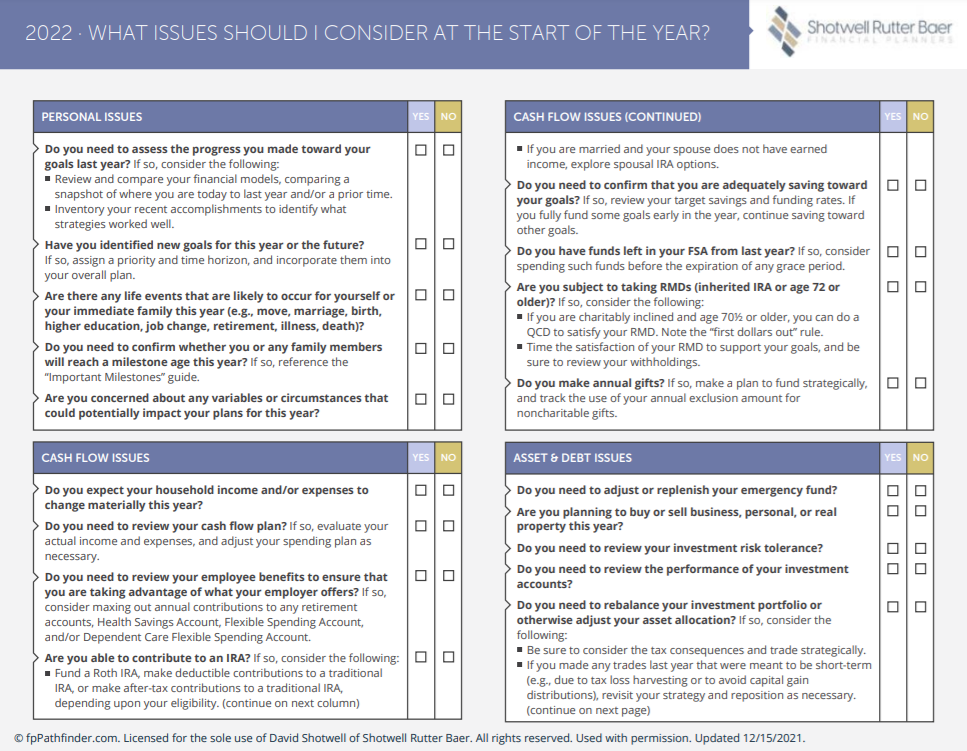

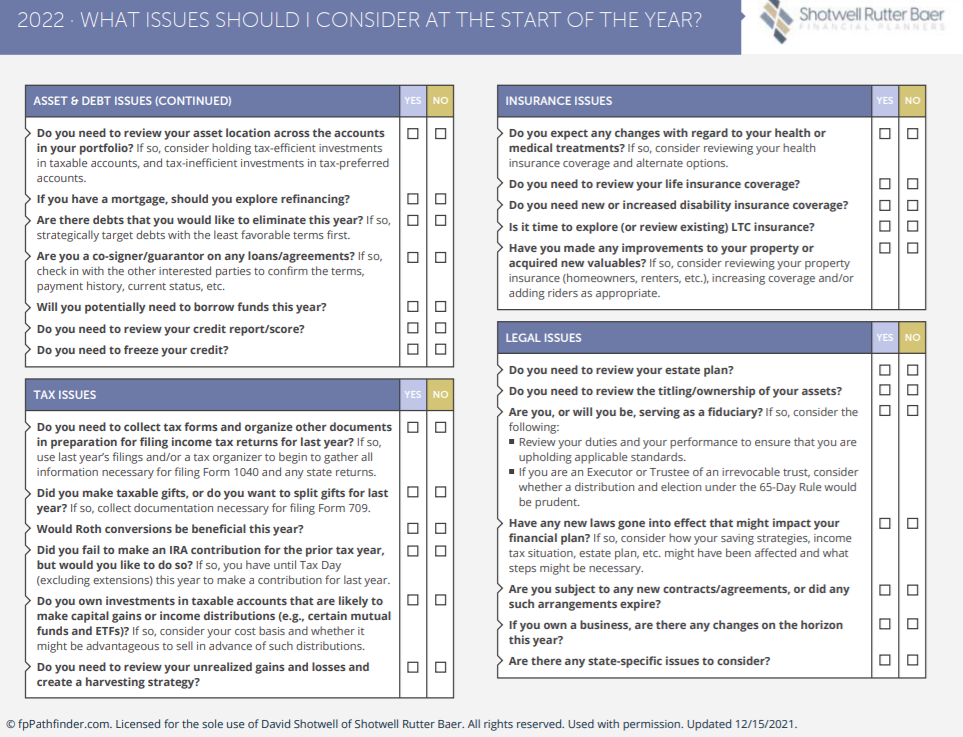

Use the checklist below to ensure you are reviewing all of your financial considerations for 2022.

Need Help with Your Financial Planning?

The financial advisors at Shotwell Rutter Baer work with many clients to maximize their retirement plan benefits and abilities. If you would like to find if there is more you can do with your plan, give us a call at 517-321-4832.

Check out our Strategic Reliable Blueprint process here.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: