Four Tips for Saving When Interest Rates are Low

Podcast: Play in new window | Download

Do you have money in savings that could be working better for you somewhere else?

Interest rates are low right now. That’s great if you are a borrower, but not so great if you have savings in the bank. With all the economic upheaval from the Covid – 19 Pandemic, the Federal Reserve has committed to keeping the Fed Funds Rate low for at least the next few years. Other rates, including savings rates, are governed by the market but take their cue from the Fed. Banks have plenty of cash on hand right now, so there’s no reason for them to offer higher rates on savings any time soon. This article outlines some things to consider with your savings when interest rates are low.

Saving When Interest Rates are Low

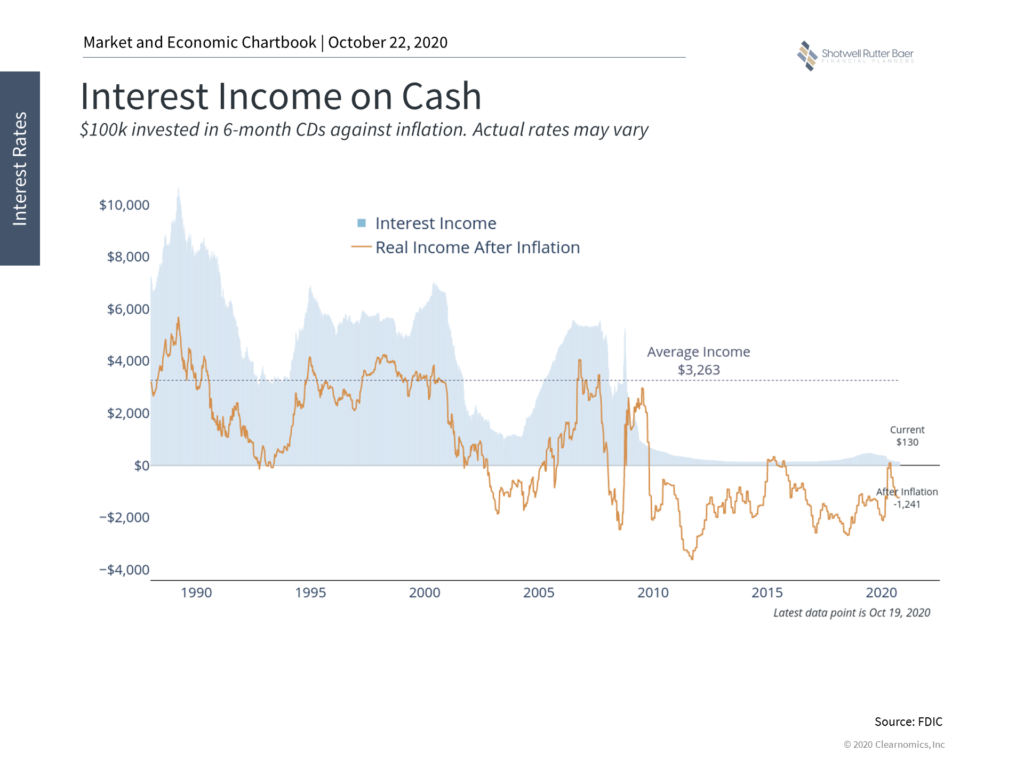

When interest rates on savings accounts are high, you can assume that inflation is higher as well, or expected to rise soon. The real income (what you’re left with when you subtract inflation from the interest you earn) hasn’t changed much historically when interest rates have changed. If rates are falling, inflation is falling as well, and vice versa.

The chart above shows interest income and real income (what you keep after inflation) for six-month certificates of deposit going back to the 1990s. You can see that from 1990-2008, the difference between interest income (shaded blue on the chart) and real income (the orange line) stayed about the same. However, since the financial crisis, real income for savings has been negative. In this environment, you shouldn’t hold more cash than you need, but at the same time don’t let a negative real return on cash holdings push you to over-invest funds that you need in the short-term.

As anyone who has worked with us knows, we always advocate that people have a contingency fund set aside in savings, along with cash to cover any spending needs for the next 12-24 months. But what do you do with those funds when savings accounts are paying next to zero and have a negative real return?

#1. Yield is the number indicator of risk:

Whether we’re talking about stocks, bonds, or cash savings, the yield tells you how the market ranks the investment risk. If one investment is yielding significantly more than another investment, there will be a reason. Sometimes one bank might offer a slightly higher rate than another bank because they want to attract new customers, and that doesn’t necessarily mean more risk. But if you see a significant difference, say more than ½ of a percent, you need to dig deeper and make sure the savings vehicle you are looking at makes sense.

A savings vehicle may have liquidity risk – which means that you need to wait a certain amount of time to get your money back. Or there may be principle risk – which means that there is a chance you won’t get all of your principle back due to market issues or because the issuer is insolvent.

#2. Give up some liquidity if appropriate:

Bank certificates of deposit (CDs) usually pay a higher rate than a regular savings account because you are committing to leave your funds in the account for a specified period. If that timeframe fits your goals, then a certificate of deposit may be appropriate. For instance, if you are planning a remodeling project that is a year away, a 12 month CD might be a good choice. However, a cd would not be a good choice for your contingency fund, which you may need to use with no notice. Keep in mind that CDs work best in a steady or falling rate environment. If rates will be lower in the future, then locking in the current rate for a while makes sense. But when rates rise, you want to be able to take advantage of the new, higher rate.

Fixed annuities are insurance products that pay a specified interest rate that is often higher than bank certificates and savings accounts and are sometimes promoted as an alternative savings vehicle. They will have a surrender period, during which you pay a penalty for withdrawing your funds early. If you are inclined to consider a fixed annuity for a portion of your savings, be sure you understand the contract terms and the surrender period and ensure that it matches your goals.

Some savings accounts offer higher yields if you keep a minimum balance in the account. In this instance, you are giving up a little bit of liquidity to maintain the higher interest, but the consequence, if you fall below the specified level, is usually just that you will receive the regular savings rate instead. If you have enough to meet the minimums, high-balance savings accounts can be a good option for cash right now.

#3. Be careful taking principle risk with short-term funds:

When we’re dealing with money for short–term goals (for example, less than two years) we generally don’t want clients to risk losing their principle due to market fluctuations. Over longer periods of time, taking market risk is a good bet, but in the short–run market up and downs can be a problem. You don’t want to be in a situation where you need your contingency fund and must worry about the fund’s current value. Fixed savings accounts are best for these purposes, despite low returns, as the biggest concern is return OF your money, not return ON your money.

Aside from avoiding market fluctuations, it is important to make sure the savings account you choose is safe. Banks and Credit Unions are usually backed by federal deposit insurance up to $250,000 per depositor, per bank. If your savings exceeds those limits, you can divide them up between different institutions to maintain coverage.

#4. Money that you don’t need soon can be added to investment portfolios:

Reassess your savings and consider your spending needs for the next few years. If you have funds in the bank that aren’t earmarked for contingencies, consider investing them rather than leaving them in savings. As always, keep your contingency funds and short-term spending in savings. Beyond that, you can consider increasing your investment portfolio. If appropriate, you can increase retirement plan contributions if the funds can be dedicated to that long–term goal. You can also consider setting up a non-retirement investment account for funds that aren’t earmarked for retirement but also aren’t needed in the next few years.

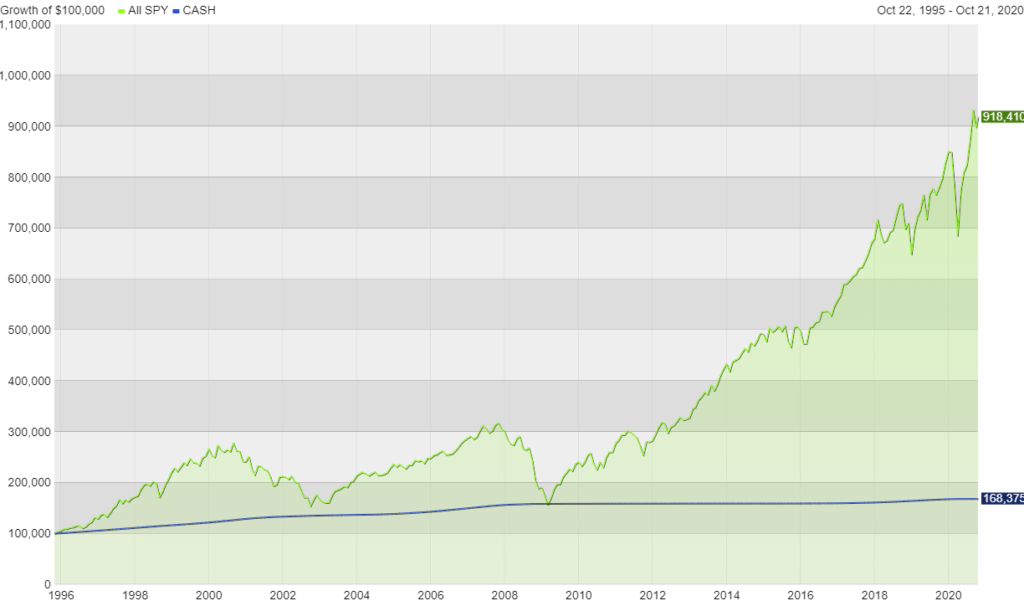

The chart below shows the difference between investing $100,000 in the S & P 500 (the five hundred largest US companies) 25 years ago compared to investing the same amount in cash investments. Over that period, cash investments would have grown by $68,000 but with no risk to principle. The stock investment would have grown by over $800,000 during that timeframe, but the ride would have been wild, including two major bear markets and the Coronavirus meltdown. When we’re investing for the long-term, those fluctuations become meaningless. But when we have short-term needs, cash is king. So we need to stick with cash vehicles even when rates are low.

Ready to Get Started?

Our financial advisors at Shotwell Rutter Baer are happy to discuss your current and future savings goals and help you determine where your money will best work for you so you can optimize your saving when interest rates are low.

Contact us today by calling 517-321-4832 or email nfo@srbadvisors.com. We look forward to hearing from you.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: