Inflation and Your Portfolio

Podcast: Play in new window | Download

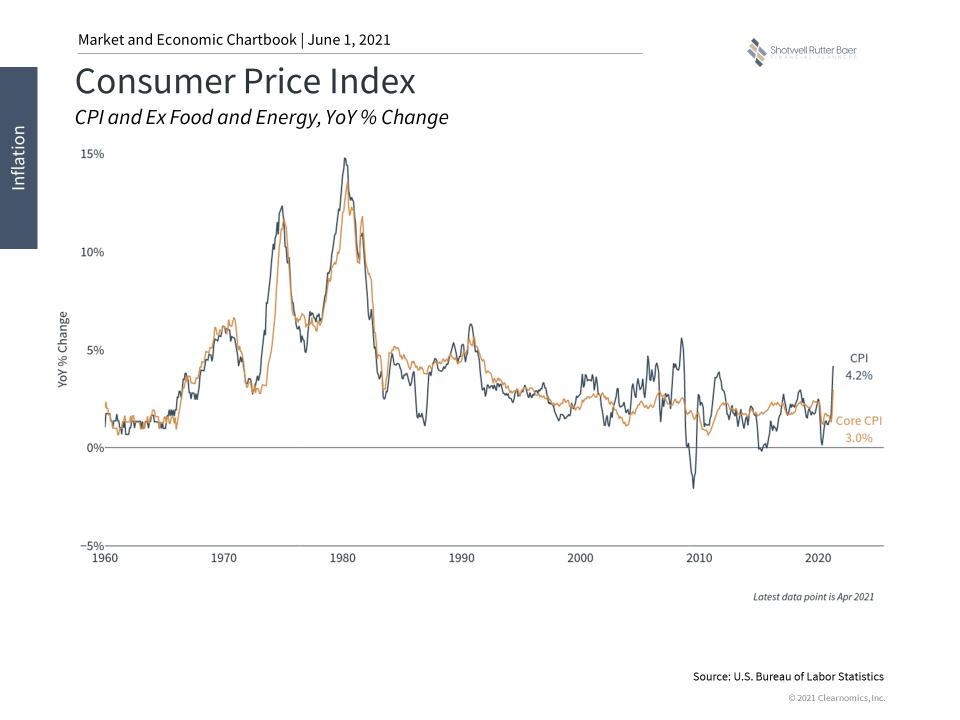

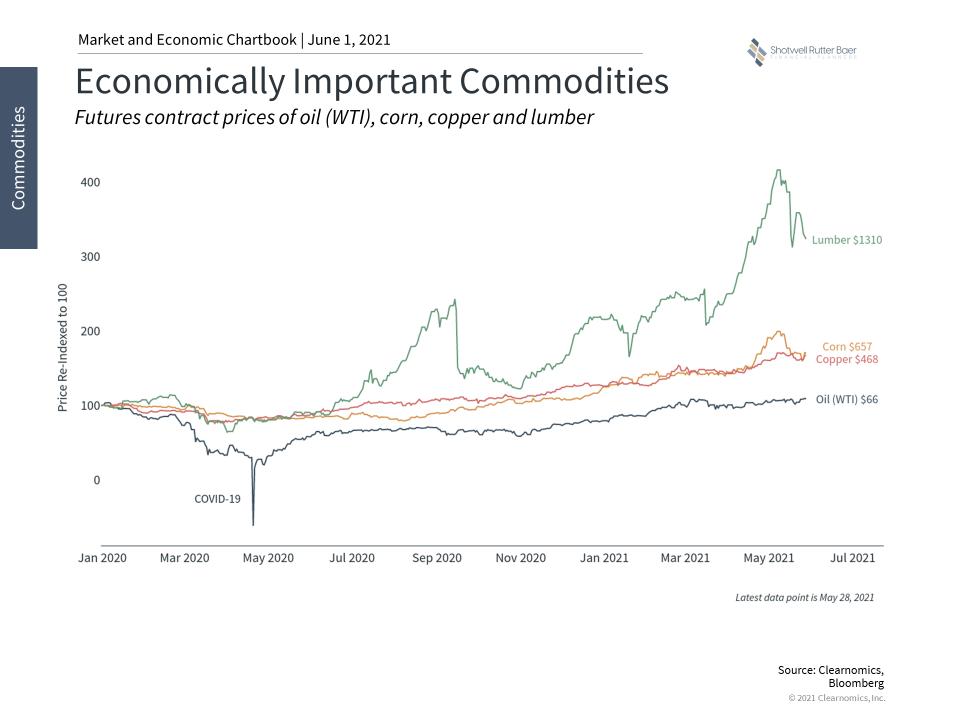

Inflation has dominated the financial headlines over the last few weeks. We’ve seen some of the fastest price increases in decades for some everyday goods and services and commodities. Inflation can impact the financial markets, and we know it has been on the minds of many of our clients.

What is meaningful to a long-term investor?

It’s important to think through the different aspects of inflation and sort out what is meaningful for a long–term investor.

Base Effect. Some of the recent increases are the result of what economists call the “base effect.” For some commodities, such as oil, prices dropped drastically last year as the economy came to a screeching halt. When prices are coming up from an extremely low bottom, or base, we can expect those increases to be fast. This type of inflation doesn’t mean much in the long term as the economy returns to normal.

Supply and demand imbalances. Other aspects of inflation are due to supply and demand imbalances brought on by the pandemic. This applies to semiconductors, housing construction, agriculture, gasoline, and many other areas where we feel a direct impact. Mines, mills, and factories were shut down last year or operated at reduced capacity, while at the same time demand increased unexpectedly for certain items as we found.

Monetary inflation. The third type of inflation, monetary inflation, is a broad increase in prices based on monetary and fiscal stimulus. Unlike supply shocks, like what we’ve seen from the pandemic, this type of inflation is more theoretical and harder to see. It is caused by too many people spending too much money too quickly. This drives prices up as output struggles to keep up. With all the recent money put into the hands of consumers, monetary inflation is more of a long–term concern. Unchecked, this type of inflation can lead to recessions. Sharp price increases mean consumers can’t afford goods, which forces producers to cut staff and stop production, creating a downward cycle.

Monetary inflation is not as big a concern for economists as it once was. While loose monetary policy led to inflation in the 1970s and 1980s, stimulus after the 2008 financial crisis did not result in inflation. Additionally, there have been strong deflationary forces over the past several decades as prices have generally fallen due to globalization, technology, and other trends.

The Federal Reserve uses interest rates to control inflation. When they raise interest rates to slow the economy down, this can cause volatility in the financial markets as traders re-evaluate their holdings.

- Part of the discussion about inflation focuses on the Federal Reserve’s plan to let inflation run a little higher than they have in the past as the economy recovers. Part of this is that they expect that most of the inflation is base effect and supply disruption.

- However, there is also some discussion that this is a bigger shift toward the fiscal stimulus. The Fed is targeting an average inflation rate now rather than a fixed target, and to get to their average target they would need to let inflation be above average for a time.

- Furthermore, one way in which governments can deal with debt is by letting inflation rise, and there is talk this may be the way the government deals with the debt taken on over the last year.

- While base effect inflation and supply disruptions are transitory and shouldn’t affect portfolios in the long run, monetary inflation can affect investors:

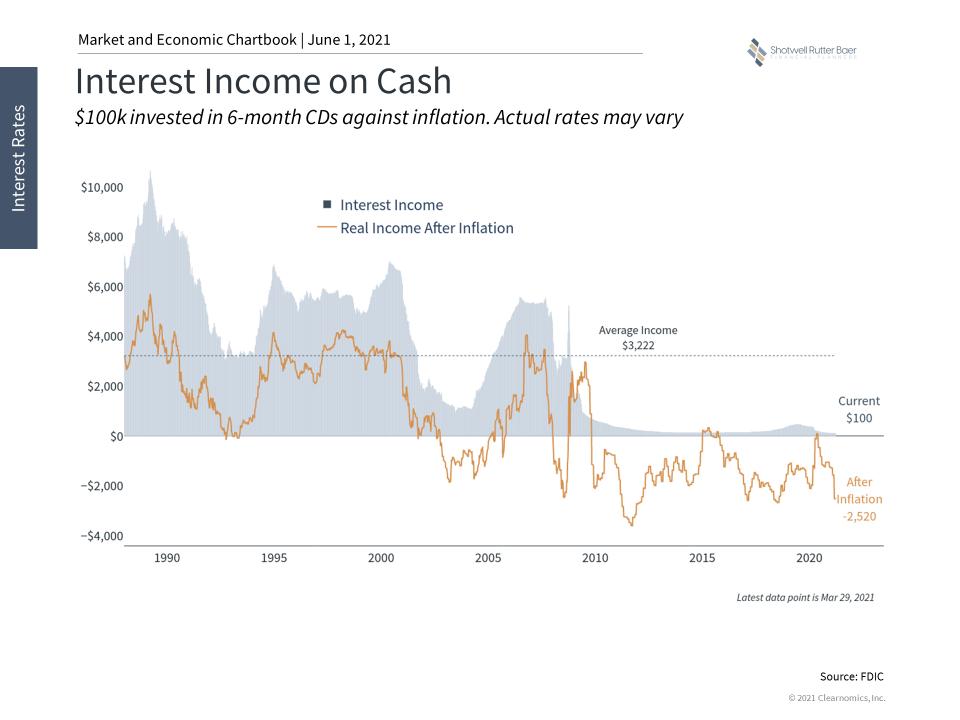

- Inflation impacts cash holdings as interest rates on safe investments don’t keep pace with inflation.

- Bond prices are hurt by rising inflation because their interest rates are fixed, and inflation means those interest payments are worthless over time.

- In the short run, rising inflation can hurt stock prices as inflation affects the valuation of corporate earnings.

- However, in the long run, stocks are the only asset class that consistently outperforms inflation. Inflation means economic growth, and economic growth should be reflected in stock market growth.

For long–term investors, the key to coping with inflation is making sure you have enough inflation-fighting assets in your portfolio to maintain your buying power and consistent long–term growth. We have already seen some of our model managers implement inflation–combating strategies in their allocations over the last few months.

Things to consider:

-

- Generally, that means you should continue to hold stocks up to your risk tolerance.

- Underweight long–term bonds in the fixed income part of portfolios.

- In some portfolios, adding exposure to real assets (commodities) can help offset inflation pressure.

Keep in mind that inflation risk is just one of the risks involved in portfolio construction and that our diversified portfolios are built with the idea that inflation is always a concern. We will continue to monitor the long–term developments. As always, if you have any questions about your specific portfolio and inflation, reach out and we can discuss your situation. Call us at 517-321-4832

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: