July 2023 Client Market Update

Back around 2001 when I was just getting started in the financial advice business, the advisor with whom I worked kept a Magic 8 Ball, the future predicting toy, on his desk. When clients would ask him to make any sort of prediction, he would pick up the ball and start shaking, then laugh and tell them what the toy had to say. “Situation murky,” “Answer cloudy,” or my favorite “Ask again later.” They got the message, and so did I. The markets and the economy are unknowable in the short – run. You may as well use a toy to predict what’s going to happen in the next few weeks or months.

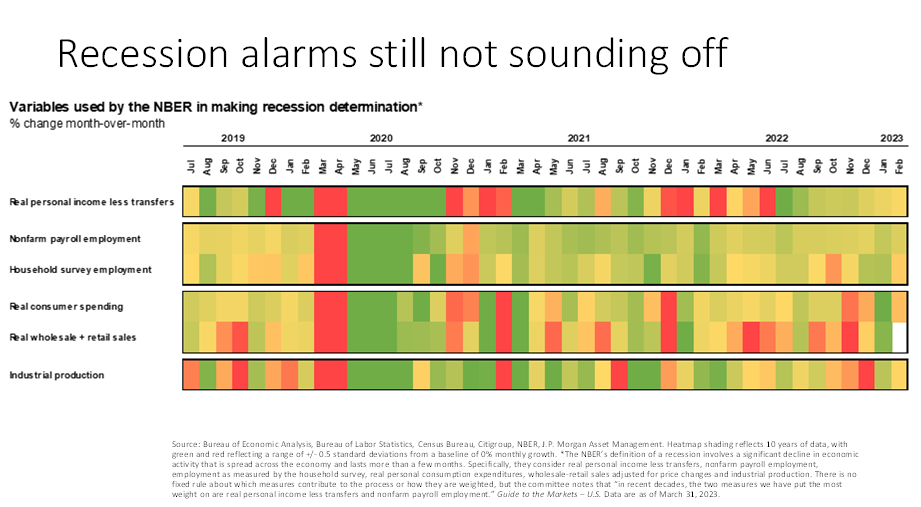

At the beginning of 2023, most economists predicted we’d be in some sort of recession by now. As of the end of June, that recession does not appear to have arrived. While indicators do show the economy is slowing down, no red lights are flashing yet. This does not mean that the environment won’t change. As discussed in our Third Quarter Economic Update and Market Review, this quarter’s list of Positive Signals and Reasons for Concern is a healthy one. Will we see inflation continue to come down without the high-rate environment causing a recession? I haven’t had that Magic 8 Ball in several years, but I’m pretty sure it would tell us to ask again later. But that’s always the answer.

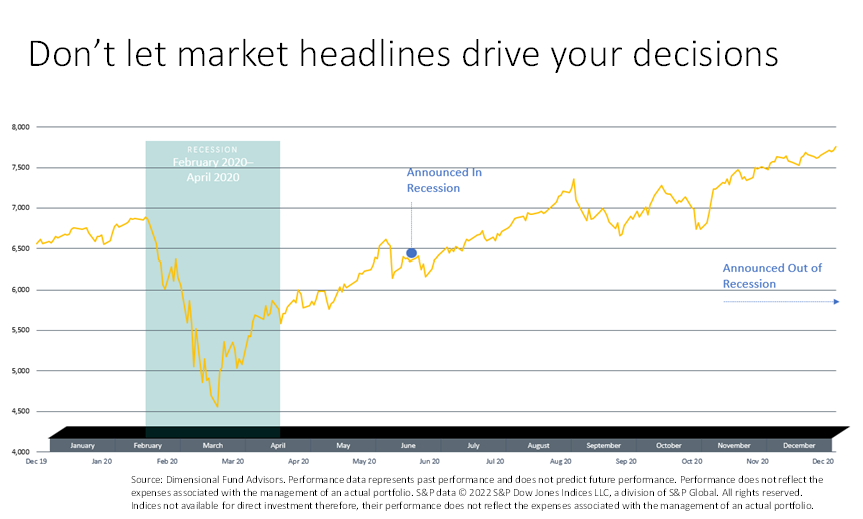

And if there is a recession, what does that mean for the markets? We often say that investors need to remember that the market is looking forward to the future while the data that tells us about a recession is all backward-looking. This chart that East Bay Investment Solutions included in their quarterly commentary illustrates this concept well, plotting market data during the last recession. It looks at the market collapse and the subsequent recovery charted against the timeframe of the coinciding recession as well as the official announcements that the recession had started. As the chart shows, the market dropped quickly in early 2020 as the Covid situation became known, but was well on its way to recovery when the economic data showing that we were in a recession was released. And by the time the data showing the recession was over could be released, the market was higher than it had been when the whole debacle began. Looking backward doesn’t matter to the market, it’s about what comes next.

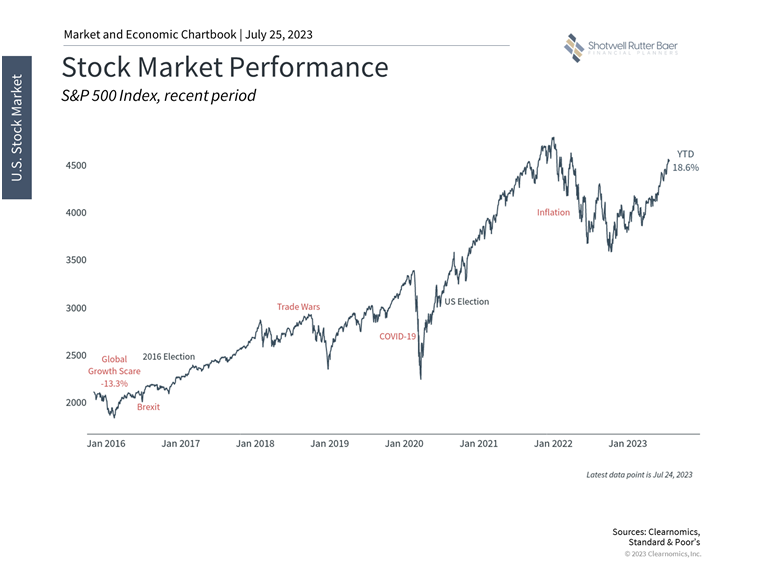

Speaking of predictions and looking forward, let’s instead look backward for a second. What a difference a year makes. The chart below shows the situation in June 2022 compared to the situation in June 2023. Mid-year 2022, the market was down -19% for the year, inflation was high with no relief in sight, and investors were ready to run to the exits. All we knew was that the Fed would need to increase interest rates to slow inflation, and that meant gloom and doom. Fast forward to now, and the situation is reversed. The stock market is positive 16% year to date, inflation is heading steadily down, and so far the economy is proving resilient. The Fed is now on a pause to see what effect all their increases have had, after an extremely aggressive campaign to slow the economy from overheating. So far there is still hope that they have managed to pull this off without overdoing it. I certainly did not predict this stark reversal, but I doubt anyone would have believed me if I had.

The stock market continued to move forward in the first half of 2022, and the S&P 500, after charting a new bull market reading last month, is now approaching its high from late 2021.

In the short – run, we need to continue to watch the inflation gauges and economic indicators such as the unemployment rate for signs of weakness. The market will no doubt be volatile as traders digest these changes and what they might mean. Longer term, we stick with our plans, remain diversified, and focus on what we can control.

Share post: