Let’s Talk About 2021 Tax Forms

Podcast: Play in new window | Download

Join Dave and Nick as they review all the things you need to consider for your taxes for 2021.

They provide information on different tax forms, distributions, tax withholdings, and all of your accounts.

For additional information, please read our recent blog Tax Documents for 2021.

The guys review things like:

- Retirements accounts (IRAs, 401K, etc)

- Distributions – 1099R forms

- Non-deductible IRAs

- IRA contributions

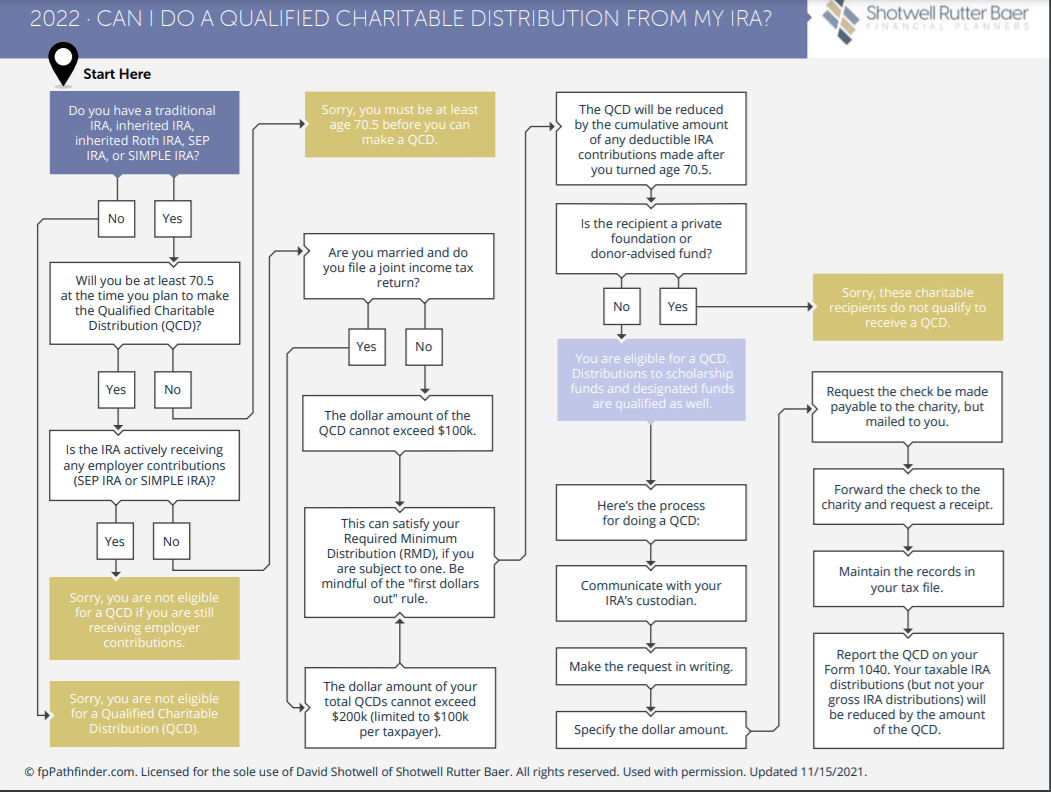

Here is the link to the Charitable Giving Strategies podcast episode we mentioned. mentioned in this episode.

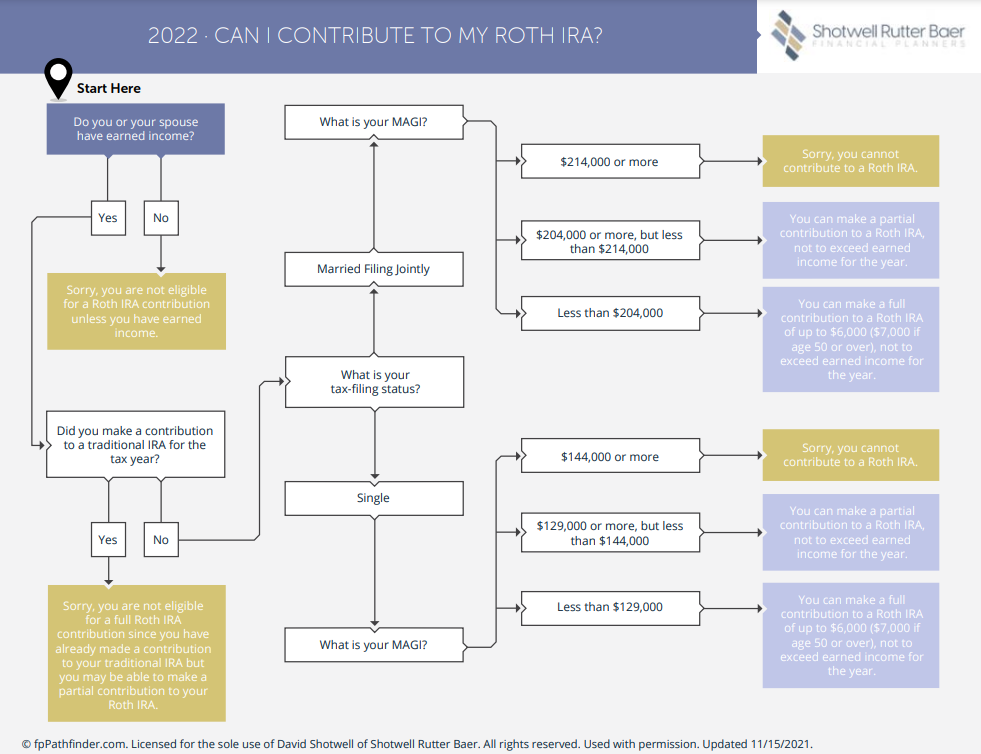

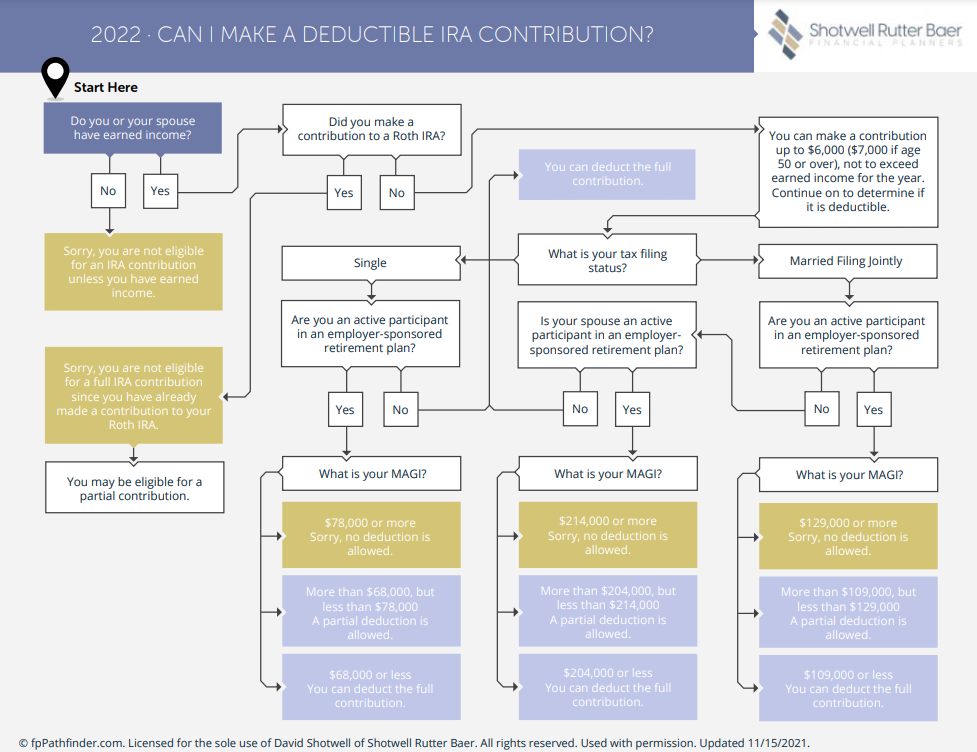

The following flowcharts will help you determine contributions, charitable distributions, and deductible IRA contributions.

As always, if you have any questions or concerns about your tax documents, please do not hesitate to reach out to our office. We’re happy to help. Call us at 517-321-4832 or email info@srbadvisors.com.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: