The Russian Ukrainian Conflict and the Economy

Podcast: Play in new window | Download

As I’m writing this in early March, the stock market, as measured by the Standard and Poor’s 500, is down just shy of 9% for the year. Russian forces are prosecuting an ugly invasion of Ukraine, adding economic uncertainty and more inflationary pressure to the markets. However, downturns caused by geopolitical events like this one are generally short-lived and we’ve enjoyed several years of a strong market.

Will the Russian Ukrainian Conflict Affect the Economy?

Today’s headlines indicate that both sides in the conflict are heading to the negotiating table in the next few days, but the situation is very tenuous. At this point, an easy resolution seems a stretch and there is a risk of the conflict continuing or even spreading beyond Ukraine.

The market reflects those concerns and will most likely remain volatile until there is some real progress toward an end and while the true economic impact of this conflict comes into focus. Our partners at East Bay Investment Solutions point out that Russian stocks account for less than 0.5% of most client portfolios. However, it is too early to tell how the economic sanctions the US and Europe are using to punish Russia will play out and affect the broader economy as undoubtedly there will be winners and losers. Furthermore, Russia accounts for a large slice of the world’s energy markets, and disruptions to that supply will likely cause more inflation concerns.

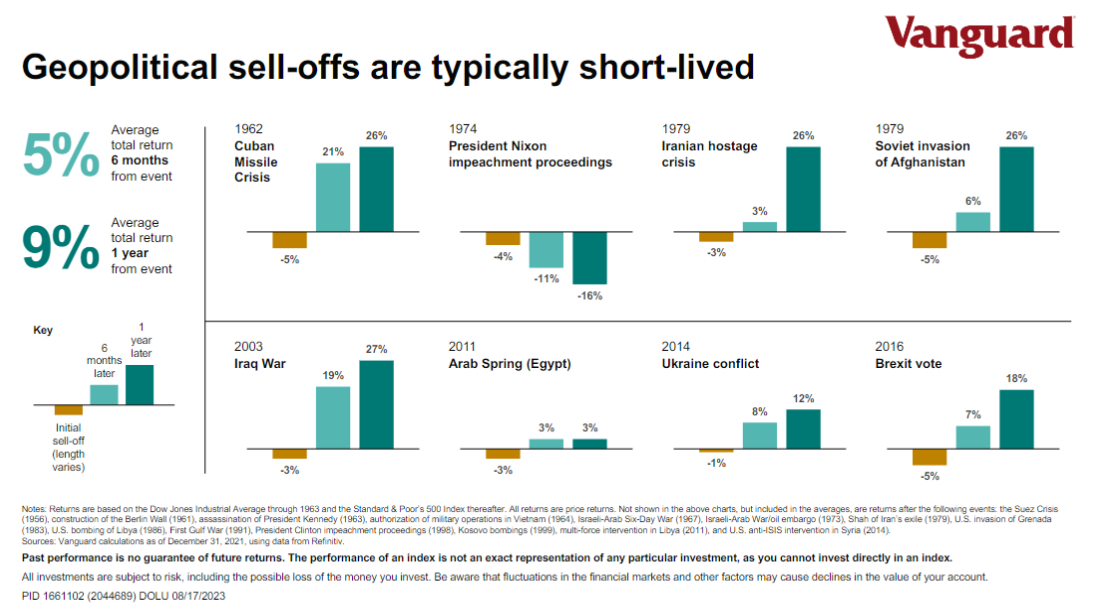

The good news, from a market perspective, is that downturns caused by geopolitical events like this one are generally short-lived. As Vanguard points out in the chart below that looks at the market during several events such as the Cuban Missile Crisis, the Iraq War, and the Soviet invasion of Afghanistan, the average market return over the 6 months after a major event has been + 5% and the average following one-year return has been 9%.

The S&P 500 Historically

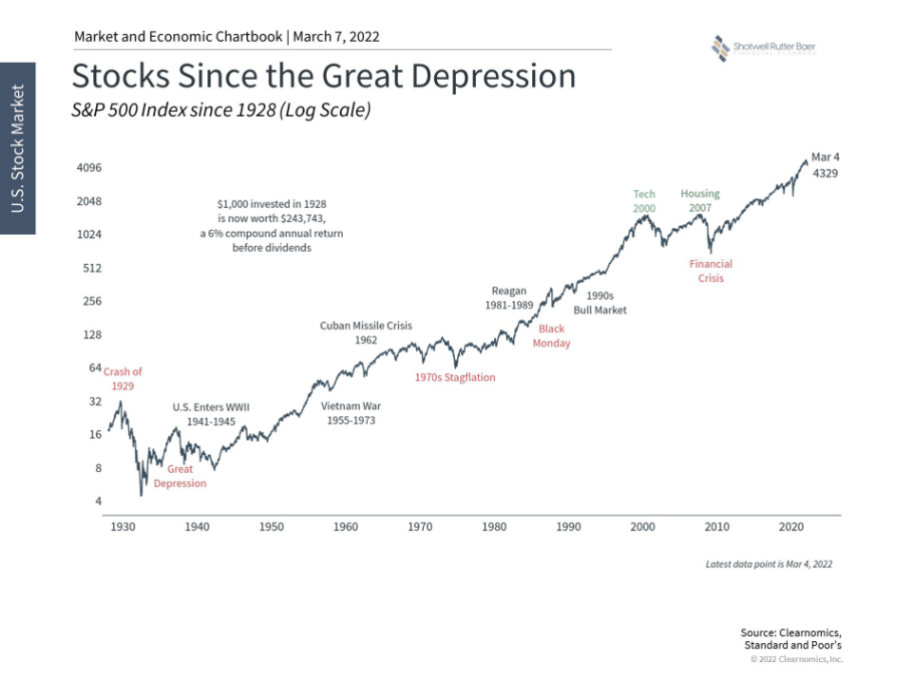

While no two crises are ever the same, the historical record would indicate that making hasty decisions around these events would be folly. And this long–term chart of the S&P 500 reminds us that the market has carried on and continued to rise through countless such disruptions since the 1920s.

You Don’t Need to Change Your Investment Strategies

Keep in mind that this down period comes on the heels of several years of strong market returns, and that, whatever the headlines, coping with market turbulence is part of investing. We do not recommend changing strategies due to situations like the Russian invasion as the short–term impact is always unknowable ahead of the event, and the situation can change for the better just as quickly.

We did not design any client portfolios believing the markets would always be positive. We’ve written about market volatility (Market Volatility Survival Guide) a lot in the past, and our advice this time is no different: don’t make hasty, emotional decisions in reaction to short–term market moves and headlines but instead focus on the long–term and gear investment decisions to how and when you intend to use your money.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: