S4E2 – 2024 Q4 Review and Market Outlook

Podcast: Play in new window | Download

Today, we’re conducting our Q4 2024 market review and upcoming market outlook. We’ll examine what happened last year and what may lie ahead to help listeners set realistic expectations.

2024 Market Highlights

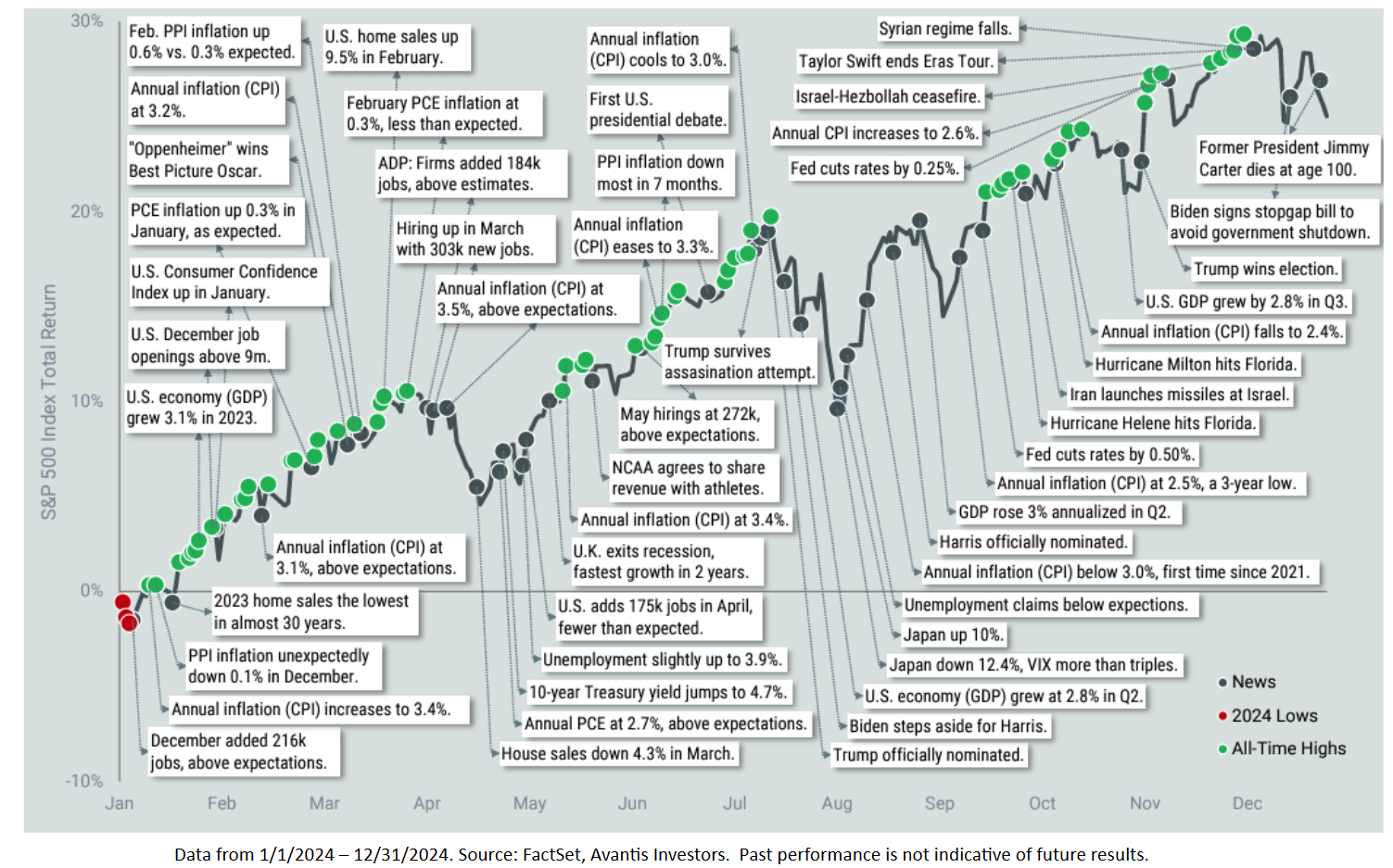

- S&P 500 Performance: 2024 closed with another year of +20% returns.

- Q4 Results: Large-cap tech stocks rose 7%, while large-cap value stocks declined slightly. International and emerging markets underperformed, but most asset classes saw positive annual returns.

- Market Resilience: Despite challenges, the market largely shrugged off concerns, including inflation, Federal Reserve actions, and geopolitical events.

Labor Market Overview

- Strength and Stability: The labor market remains resilient with low unemployment, despite significant interest rate hikes in 2022 and 2023.

- Sector Variability: Growth is concentrated in healthcare and government sectors, while tech lags. Overall, the labor market is robust, supporting strong consumer spending.

Interest Rates and Yield Curve

- Rates and Inflation: Interest rates have stayed higher than expected, with the Federal Reserve lowering short-term rates in late 2024. However, long-term yields have risen, signaling a return to a normal yield curve.

- Implications: A normal yield curve is a positive economic indicator, even if it frustrates those seeking lower mortgage rates. Elevated yields provide better returns for fixed-income investors.

Glass Half Full: Positive Economic Indicators

- Resilient Economy: Strong labor markets and steady consumer spending support GDP growth.

- Higher Yields: Safer investments now offer real returns, benefiting income-focused investors.

- Policy Outlook: Growth-focused policies and deregulation could provide short-term economic stimulus.

Glass Half Empty: Potential Challenges

- Inflationary Risks: Policies like tariffs and reduced immigration may drive inflation by increasing costs for labor and goods.

- Housing Market: High mortgage rates and limited affordable housing construction remain obstacles.

- Market Valuations: Two consecutive years of +20% returns may not be sustainable without corresponding earnings growth.

Key Takeaways for Financial Planning

- Timing the Market: Just as timing the stock market is difficult, waiting for the “perfect” time to buy a house is unrealistic. Focus on personal priorities and long-term plans.

- Valuation Concerns: High market valuations require strong earnings growth to sustain current levels. Monitor earnings reports closely for alignment with market expectations.

At Shotwell-Rudder Bear, our approach starts with a fit meeting to see if we’re the right match for your financial needs. Trust is the foundation of our relationships, and we’re here to help you create a tailored plan. Visit srbadvisors.com to get started today.

You can also reach out by calling us at 517-321-4832 or info@srbadvisors.com.

Don’t miss an episode of Kitchen Table Finance by subscribing to our YouTube Channel.

Share post: