Understanding Required Minimum Distributions

Podcast: Play in new window | Download

Breaking down the deal with Required Minimum Distributions.

After you turn 72 years old, you will need to take a minimum amount out of your traditional IRA accounts each year. This also applies to your 401k or 403b accounts if you are no longer working for the businesses sponsoring those plans. The minimum required amount referred to as your required minimum distribution, or RMD, is based on a formula provided by the IRS that changes every year based on your age.

In the year you turn 72, the deadline for taking the distribution is April 1 of the following year. In subsequent years, you need to take the required minimum prior to December 31 of that year.

Note that the age for required minimum distributions changed in 2018. Prior to that change, the magic age was 70 1/2. If you were born before July 1, 1949, then the old rule applies, and you should have already started minimum distributions. If you were born after June 30, 1949, then you can wait until you turn 72.

Calculating Required Minimum Distributions

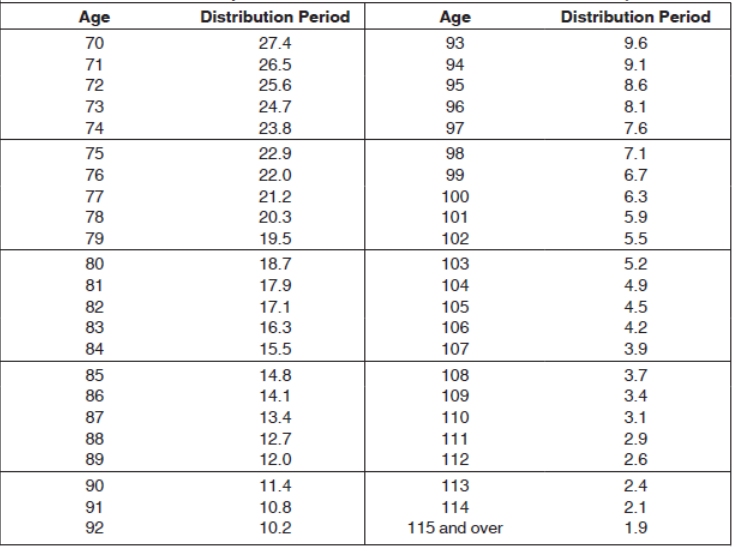

You can calculate your required minimum distribution amount by dividing your IRA balance on December 31 of the previous year by a number that represents your expected “Distribution Period,” which is taken from the IRS table below. For example, if your IRA balance was $100,000 on 12/31/20 and you turn 72 years old on 10/1/2021, you would divide $100,000 by 25.6, and your required minimum distribution for the year would be $3,906.25.

Below is the IRS Uniform Life Table that applies to most retirees. If your spouse is the sole beneficiary of your IRA and he or she is more than ten years younger, you can use the IRS Joint Life and Last Survivor Expectancy Table, which allows for smaller required minimums. If you are the beneficiary of an IRA and you weren’t the owner’s spouse, you use a different table, called the IRS Single Life Expectancy Table.

IRS Uniform Life Table

Here are some tips for taking your Required Minimum Distributions:

- While in the year you turn 72 you can wait until April 1 of the following year to take your distribution, we advise most clients to go ahead and take the distribution before 12/31 of the year they turn 72 anyway. Because the following year’s calculation is based on the 12/31 value of the previous year, delaying means that amount for the following year will be slightly bigger. Furthermore, delaying until 4/1 of the following year means you will be taking two distributions in that year, as the current year’s distribution will be due by 12/31. Taking two RMDs in one year increases your taxable income for that year and may place you in a higher marginal tax bracket.

- For asset management clients, we will calculate the RMD in early January for any clients that are required to take them. No need to pull out the tables and do the math. We’ll talk to you about them during review meetings, and we’ll bug you in the fall if you haven’t made plans to take them by year-end.

- The penalty for not taking your RMD by the deadline is pretty steep: The tax penalty totals 50% of any undistributed amount that you should have taken but didn’t.

- Keep in mind that the calculation is only the minimum you need to take: If you need more money than the RMD as part of your retirement plan spending, that is not an issue.

- The IRS doesn’t care how you take your distributions. You can divide them up and take them monthly, take them as a lump sum all at once, or take them in several smaller lump sums throughout the year, as long as the total at the end of the year satisfies the minimum. The IRS also doesn’t care what you do with the distributions, so long as you take the funds out of your IRA and pay the taxes that are due. Most of our clients use their required minimum distributions for spending money, but some move them into an after-tax investment account instead.

- We can have taxes withheld from your distributions to cover federal and state taxes. Prior to sending out the distribution, we can work with you and your tax advisor to calculate the proper amount of withholding.

- You will receive a 1099 – R from your IRA in early February of the following year showing how much you took out and how much you had withheld for federal and state taxes.

- If you have multiple IRAs, they are totaled together to determine your overall RMD. However, you can choose which accounts you wish to use for the distributions. As long as the overall total distributions from all your IRAs cover the total RMD, you can take the distributions all from one account, or divide them amongst the accounts as you see fit.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: