When should you refinance your mortgage?

Podcast: Play in new window | Download

When should you refinance your mortgage?

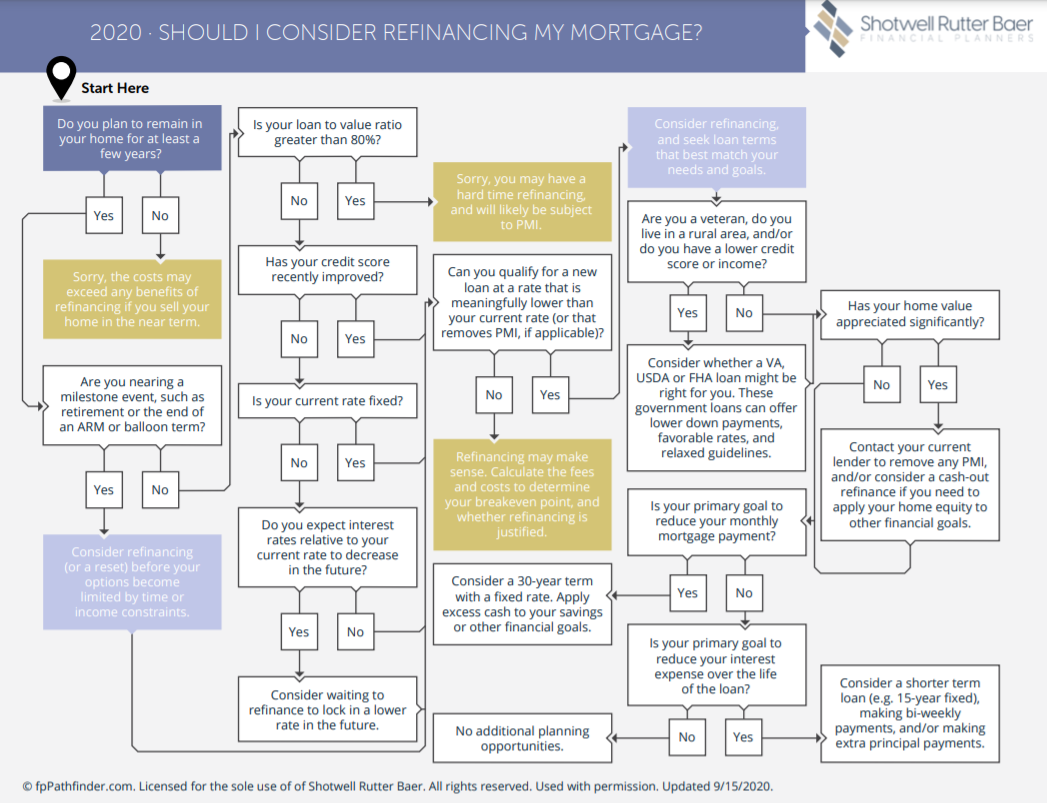

Low-interest rates may not be good for your savings account, but it could save you thousands of dollars on your mortgage loan. How do you tell if now’s the right time for you to refinance your existing mortgage?

You may think that this would be a cut and dry decision. If you can get a lower interest rate than what you are currently paying, then you should go ahead and pull the trigger. Unfortunately, mortgages are not that simple. There are several issues to consider when deciding whether to refinance.

What to consider when refinancing your mortgage:

- What are the terms of your current mortgage?

- How long will you stay in your home?

- Are you near retirement or have an Adjustable Rate Mortgage (ARM) coming due?

- What is your current loan to home value?

- Has your credit score improved?

- Is your goal to reduce your current payment or reduce your interested expense?

What are the terms of your current mortgage?

Start by looking at your current loan and compare your current interest rate to the new advertised rates. A general rule of thumb is to refinance if new rates are at least 1% lower than your current rate

Keep in mind that when your mortgage payments are calculated, a larger portion of your early payments goes toward interest than toward principle. If you have been paying on your current loan for several years, you may have paid a lot of the interest already while a large portion of your payment is applied to principal. Refinancing will start the loan over again, and more of the payment will be interest.

How long will you stay in your home?

If you plan on moving in the next few years, refinancing isn’t your best choice. The front-end fees of a mortgage can set you back a few thousand dollars. You will recoup the front-end fees by paying lower interest over the life of your loan, but often the breakeven point is 5-7 years down the road. It’s a best practice to work with your loan officer or financial advisor to determine what that breakeven point would be for your specific loan.

Are you near retirement or have an ARM?

If you are about to retire and your income is changing, you may not qualify for the same terms that you would if you were working. Likewise, if you have an adjustable-rate mortgage that is about to adjust to a higher interest rate, you may not have the time to wait for a lower interest rate.

Having a mortgage in retirement can also be challenging from a planning perspective. You’ve likely heard that you shouldn’t have any debt when you retire, yet lots of folks retire happily with a mortgage they are still paying. How well you tolerate risk is helpful in determining whether you should pay off your mortgage before retirement. It’s best to bring this up with your financial planner as you create your retirement plan to find the best solution for you. Just know that if you plan on paying off your mortgage before you retire in the next 5-10 years, it’s probably best not to refinance.

What is your current loan to value?

If you owe more than 80% of the value of your house, refinancing might not be your best option. You may find it difficult to refinance, and you will likely be subject to private mortgage insurance (PMI). The terms of your loan significantly increase when you owe less than 80% of the value of your house. Avoiding PMI can make a big difference in your breakeven point of refinancing.

Likewise, if you have paid off most of your mortgage, refinancing may not make sense. Keep in mind that early in a mortgage, more of the payment is interest while later in the mortgage more of the payment is principal. Refinancing re-starts that clock. If you’ve been paying on a 30-year mortgage for a long time and refinance to another 30-year mortgage, your payment will be lower but your interest cost over the life of the new mortgage will likely be higher than staying put.

Has your credit score improved?

Your credit score is another significant factor in the rate and terms of your mortgage loan. If you had a lower credit score when you got your mortgage and things have improved, chances are you are in a better position to get a lower rate. The combination of a lower interest rate environment and a higher credit score could improve the interest rate on your refinance by quite a bit. You’ll still want to calculate the fees and cost of refinancing to determine your breakeven point. The more of a drop in interest, the more likely it is that a refinance is in your best interest.

Is your goal to reduce your current payment or reduce your interested expense?

One of the things that you want to consider is if your goal is to lower your payment or to reduce your interest expense. If you are looking to reduce your payment so that you can transition into retirement or save that money toward your retirement in a ROTH IRA, then you probably want to look at a long term 20-30 year fixed loan. If your goal is to reduce the interest that you pay over the life of the loan, then you want to look at a 15-year loan and even make a bi-weekly or extra principal payment every month to pay it down quicker.

It’s usually not a great idea to refinance a mortgage to pay off other debts (cash-out refinance). It might make financial sense to pay off the high-interest debts (credit cards, unsecured loans, etc.), but it typically won’t fix your problems. You would be better off staying where you are and tracking and managing your budget regularly. We find that the quick fix that doesn’t address the underlying issue of managing your cash flow won’t work. It would be best if you put in the hard work to create and live by a budget. Once you do that, you stand a much better chance of not getting into the same position over again.

Interested in learning more about whether a refinance is right for your financial plan? Download our 2020 Refinancing Guide or contact us at info@srbadvisors.com

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: