Why We Don’t Recommend Individual Stocks

Podcast: Play in new window | Download

Frequently when we meet people who handle their own investments, they like to talk about individual stocks. I can understand why. Individual stocks have a story that you can wrap your head around, such as Pfizer creating a vaccine for Corona Virus, to borrow from current headlines. Or Tesla bringing the auto industry forward into the next century.

Financial planners almost always recommend using mutual funds – portfolios made up of many different stocks and bonds – to build a portfolio. They’re boring compared to the excitement of individual stocks, but in the long-run, they are a better solution for building a portfolio.

Portfolios are Better than Individual Stocks

The diversification gained by investing in funds greatly reduces portfolio risk. There are two main types of risk in the stock market.

#1. Systemic risk. A short-term, general risk that’s associated with being in the stock market. The market tends to rise and fall in anticipation of economic change. Systemic risk affects all stocks together and there is no way to avoid it if you’re going to be in the market. The risk is part of the system. While in the short-run, systemic risk is a concern, in the long-run investors are rewarded for taking systemic risk as the economy, and thus the market grows.

#2. Non-systemic risk. This is inherent to investing in individual stocks. Non-systemic risk, sometimes called business risk, is the concern that a company can have problems that are specific to its business rather than the whole market. For instance, a drug company can have a trial go poorly, or a car company can have a safety issue. While individual stocks always have systemic risk, rising and falling with the general market, these non-systemic risks add another layer of concern. Companies can lose value through management mistakes, fraud, or just bad luck. They can even go bankrupt leaving their stock worthless.

Which is better?

While taking systemic risk pays off in the long-run, there is no evidence that taking the additional non-systemic risk of investing in individual companies leads to better returns. Over time, individual stocks tend to perform in line with the broad market. If they outperform the market for a period, they will also underperform at some point, bringing the induvial stock’s return in line with the rest of the stock market.

You may get lucky and buy at the beginning of a period of outperformance. Then you also need to be lucky and sell the stock before it begins to underperform. Because markets are usually efficient, which means that the price of a stock today is based on everyone’s opinion of all the public information available about a company, timing these cycles is mostly making lucky guesses.

The non-systemic risk of investing in individual stocks can be eliminated by diversification. Spreading the risk around among many different companies. Research has shown that it takes between forty and fifty stocks to create enough diversification that non-systemic risk is no longer a concern. Mutual funds do this automatically, making it possible to buy a whole package of stocks at once for instant diversification.

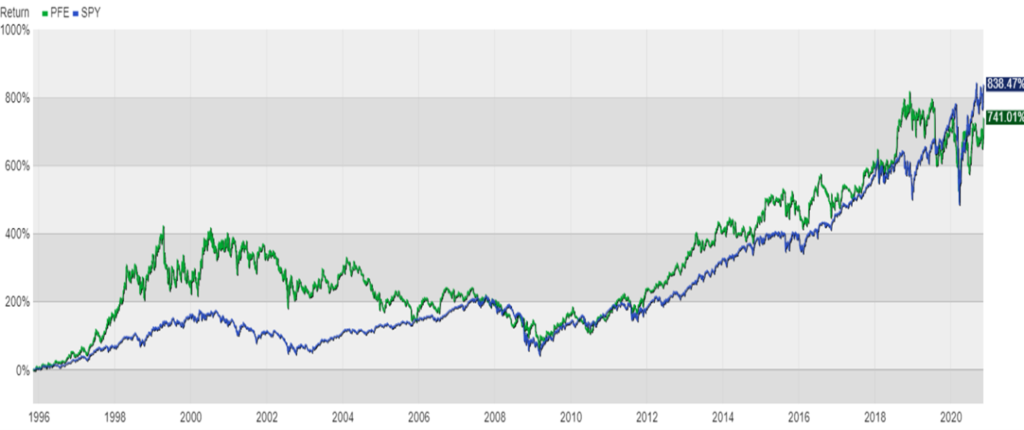

This chart compares Pfizer stock to the Standard and Poor’s 500 Index over the last 25 years. There are times when Pfizer outperforms the broad market, but there are also times when it lags and the market catches up. In the long – run, both end up in about the same place.

About Shotwell Rutter Baer

Shotwell Rutter Baer is proud to be an independent, fee-only registered investment advisory firm. This means that we are only compensated by our clients for our knowledge and guidance — not from commissions by selling financial products. Our only motivation is to help you achieve financial freedom and peace of mind. By structuring our business this way we believe that many of the conflicts of interest that plague the financial services industry are eliminated. We work for our clients, period.

Click here to learn about the Strategic Reliable Blueprint, our financial plan process for your future.

Call us at 517-321-4832 for financial and retirement investing advice.

Share post: