Dave’s Client Update October 2023

As I’m writing this, the conflict in the Middle East following the Hamas attacks on Israel earlier this month has captured the headlines and taken investor attention from the banal interest rate/inflation discussion that has been ongoing for close to two years now. This brings new uncertainty into the short-term economic equation, an issue that only a few weeks ago was not on our radar.

Last week we posted an article on our blog from our partners at Clearnomics that looks at the history of Middle East conflicts and their impact on the economy and markets. The history of these events shows that the impact on the markets depends mostly on the state of the economy when the events occurred. Events like 9/11 and the wars in Iraq and Afghanistan came in the context of the dot-com crash. The markets were already ugly and continued to be ugly. Last year’s invasion of Ukraine came amid an already tough time for the markets as we wrestled with inflation.

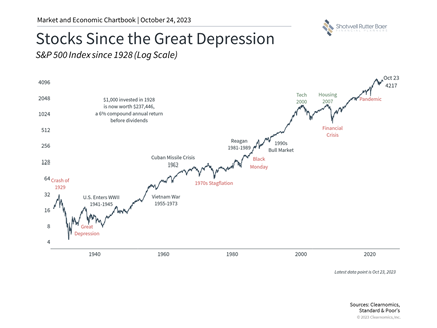

A common client question when something like this grabs the headlines is “If this event causes the market to fall apart, how do you protect our money?” The question takes a view of the market – a very common view – as a ship that may start taking on water and begin to sink, allowing time to man the lifeboats and escape to safety. But that the ship will inevitably sink is a given. The market does not work like that: the market reacts to news very fast, positive, or negative, then waits to see if reality is better or worse. The next piece of data comes in, and the market again reacts one way or the other. You can guess what the next data point will be – whether it will be a positive surprise or another negative surprise – but a guess is all it really is. This view also assumes the market will either not recover or will give an all-clear signal when the danger has passed.

So, the answer to these client questions is simple, but never easy in the moment: To be invested means you must assume the risk that global events will happen. You prepare ahead of time by making sure you have adequate contingency funds on hand so you can stay invested if (when) the market falls apart. This is why we diversify among stocks and bonds, and why we preach that everyone should have safe money available for the bad times. The market recovers and then grows, and you want your investments in place when that happens.

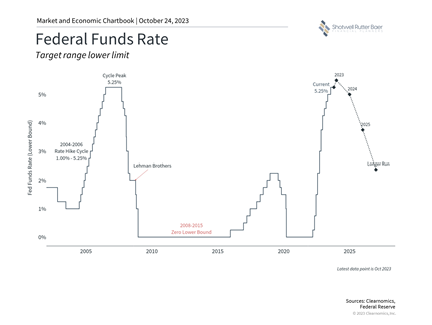

Meanwhile, the stock market remains positive for 2023 despite a rough third quarter taking back a portion of the gains from the early part of the year. As we discussed in last week’s Economic Review and Update, the backdrop to the situation in Israel and Gaza continues to be the story of inflation and interest rates. While the Federal Reserve paused their rate increases in September, they signaled that they expect to raise rates at least one more time and have to keep them higher for longer than previously expected to tame inflation. With the prospect of near-term rate cuts off the table.

The longer rates remain high, the more difficult it is for the Federal Reserve to pull off the soft landing they have been working toward, where they tame inflation without causing a recession. So far that soft landing is still in play as we head toward the end of 2023.

As always, we are available to talk to you more about these concerns, your investments, and your thoughts anytime. Please feel free to contact us at 517-321-4832 or info@srbadvisors.com.

Share post: